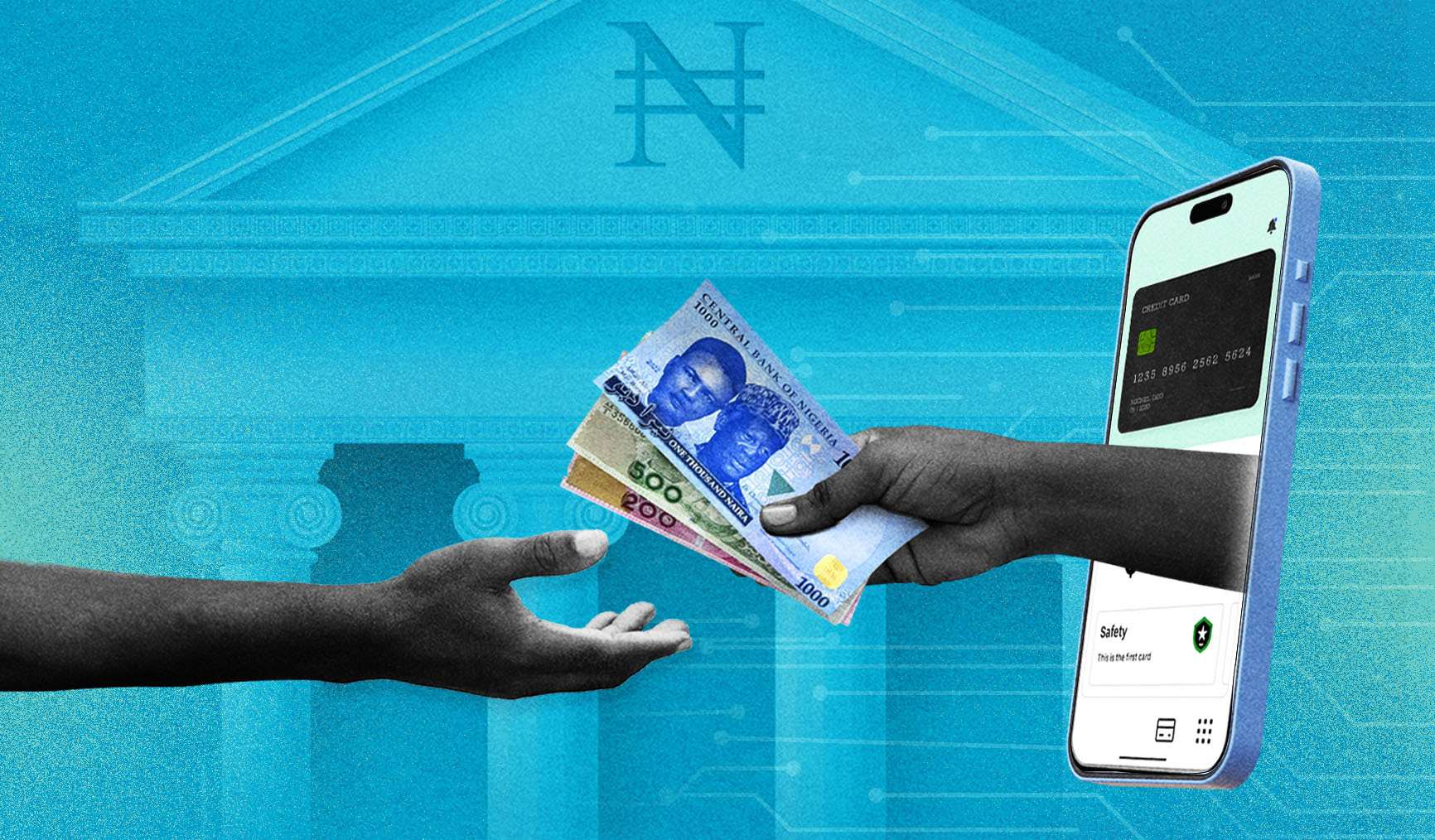

The Central Bank of Nigeria (CBN) Governor, Olayemi Cardoso has revealed that mobile money and digital lending are expected to drive growth in the service sector in 2024. The announcement was made during the launch of The Nigerian Economic Summit Group 2024 Macroeconomic Outlook Report.

Cardoso emphasised that these sectors would continue to dominate economic expansion in the country, projecting a 3.76% growth rate for the economy in the upcoming year.

The CBN Governor highlighted the increasing reliance on fintechs and digital solutions, anticipating their pivotal role in shaping Nigeria’s economic landscape. He cited factors such as mobile money adoption, government partnerships, and expanded digital lending offerings as key drivers propelling growth in the fintech sector.

Read also: Digital Africa to invest in Côte d’Ivoire’s Fatala Digital House

Optimistic Outlook Across Various Sectors

Expressing optimism, Governor Cardoso outlined positive growth prospects across multiple sectors, including industry, services, agriculture, and mining. He attributed this favourable outlook to market-based reforms, private investment, and SME-led initiatives aimed at bolstering business improvement and confidence.

Fintech’s Role in Nigeria’s Economic Ambitions

Governor Cardoso reiterated the significance of the fintech industry in Nigeria’s ambition to become a $1 trillion economy. He identified fintech, along with other sectors such as agri-processing, oil and gas, manufacturing, real estate construction, and infrastructure, as key areas poised to attract substantial capital investments into the country.

Despite his optimism, Governor Cardoso stressed the CBN’s commitment to ensuring regulatory compliance within the fintech sector. He emphasised the need for licensees to adhere to approved activities, warning of sanctions for non-compliance. The CBN intends to develop a new regulatory framework suitable for the evolving payment services landscape while conducting a comprehensive review of the licensing framework.

Rising Adoption of Mobile Money and Digital Lending

Mobile money adoption and digital lending have witnessed significant growth in Nigeria, particularly as the CBN advocates for a cashless economy. Reacting to the growth, global mobile operators unifier, GSMA explained that the number of mobile money agents surged by 41% in 2022, with Nigeria experiencing substantial growth.

According to GSMA, Nigeria’s “…liberalised regulatory regime led to an increase in MMPs. Agents are an important part of any mobile network service and were responsible for two-thirds of all cash-in transactions in 2022.”

Additionally, digital lending is gaining traction, with 211 licensed digital lenders operating in the country, catering to the evolving financial needs of Nigerians amidst economic challenges.

As Nigeria navigates economic growth and digital transformation, the convergence of mobile money, digital lending, and fintech innovation is poised to play a pivotal role. With regulatory oversight and technological advancements, these sectors are expected to contribute significantly to financial inclusion, economic empowerment, and Nigeria’s broader economic ambitions in 2024 and beyond.