Knife Capital’s US$50 million African Series B expansion fund, Knife Fund III, reached its second close with backing from Standard Bank and the SA SME Fund. Knife Capital is a venture capital and growth equity investment firm that focuses on businesses that have shown they can make money and are driven by innovation. Knife Fund III wants to fill an important financial gap and help innovative African businesses grow.

After the second Knife Fund III closure, the provisional commitments reached just over US$40 million, and Knife Capital is wrapping up the legal and due diligence processes for a few more donors to reach the US$50 million goal. With its commitment, Standard Bank Group, the biggest bank in Africa in assets, joins other domestic and foreign companies as significant participants in the fund.

Read also: African Investment Platforms Close Venture Fund at $112 million

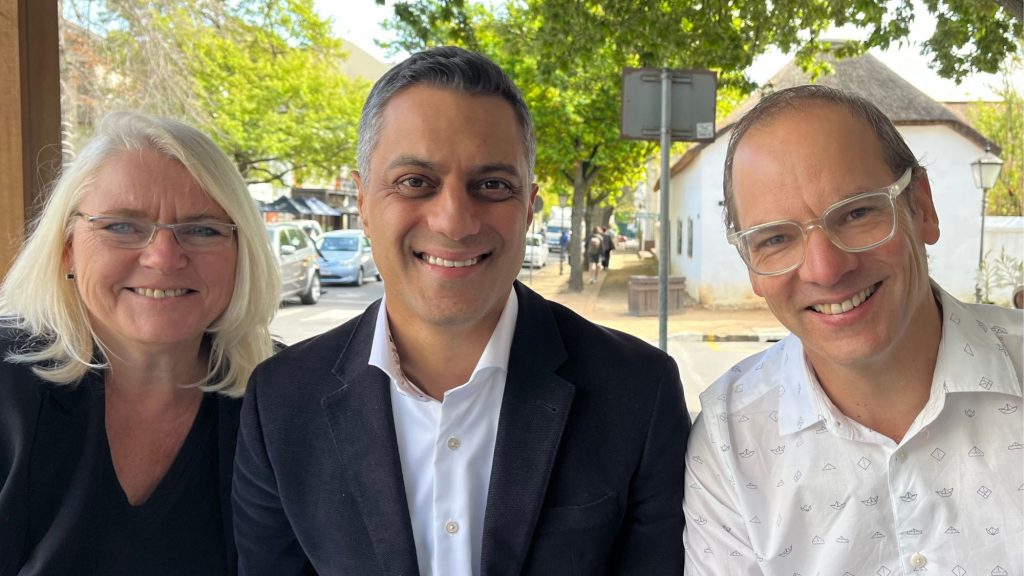

“Standard Bank believes in the positive impact that investments in early-stage, high-growth businesses can have on innovation, job creation, and the economic development of South Africa. Knife Capital is the newest addition to our venture capital portfolio, and we are pleased to have worked with many of the top investors in this field. According to Akash Maharaj, executive of equity finance and investments at Standard Bank Corporate and Investment Banking, “We can facilitate the growth journey of businesses that scale internationally with Standard Bank’s expansive African footprint, our suite of bespoke banking products, and our substantial client base.”

The co-founder of Knife Capital, Keet van Zyl, said, “We are very excited to get Standard Bank not only as a backer but also as a development partner for our portfolio businesses.”

“With its infrastructure throughout the continent, they are already demonstrating that they are a value-adding banking partner with the resources and know-how to safely deploy capital as well as the vision to impact good change in African developing markets,” the author writes.

Standard Bank invests in technology and innovation for a sustainable future.

The lack of support from regional institutional investors for venture capital as an alternative investment asset class hurts entrepreneurship with a big impact in Southern Africa. Standard & Poor’s lays the groundwork for how financial institutions might approach this asset class by committing too many growth equity funds.

Through investments in technology and innovation, a better and more sustainable future for everybody may be achieved, which Standard Bank has done with Hlayisani Capital and is about to do with a few more funds. As of the second close of Knife Fund III, which brought provisional commitments to just over $40 million, Knife Capital is finishing the legal and due diligence processes for the last few investors to reach its $50 million goal. Other reliable investors who have already committed are the IFC, the Mineworkers Investment Company, the SA SME Fund, foreign development funders, and well-known family offices.

SA SME Fund supports local venture capital firms

The SA SME Fund has supported a variety of local venture capital firms, notably Knife Capital’s KNF Ventures and Grindstone Ventures, to affect the South African early-stage investing market significantly. “We develop South Africa’s huge entrepreneurial spirit through long-term collaborations and are thrilled to follow on to Fund III to continue supporting Knife Capital,” said Ketso Gordhan, CEO of the SA SME Fund. Knife Fund III supports Knife Capital’s investment strategy based on the “value chain.” It also builds on the momentum and success of Knife Capital’s previous funds. The main focus will be on scalable business-to-business technology firms with attractive exit options will be the main focus.

The fund is in a great position to directly support the fast growth of South African start-ups and co-invest with other reliable investors in businesses all over Africa. It has already made its first investment, leading a $10 million round in DataProphet, a company that sells artificial intelligence software as a service to the manufacturing industry.

The co-founder of Knife Capital, Keet van Zyl, was excited that Standard Bank was joining his portfolio companies as a development partner. Knife Fund III solved a major problem for the Southern African venture capital asset class: the lack of follow-on financing. This gap has kept businesses from reaching their full potential or giving up too soon. The fund comprises a limited partnership in Jersey worth USD and a limited partnership in South Africa worth ZAR. Both will invest in portfolio companies together.