Apple users will soon be able to use Affirm’s “buy now, pay later” loans to pay for things, the companies said Tuesday.

The San Francisco-based fintech company Affirm said in a filing that U.S. Apple Pay users on iPhones and iPads will be able to use Affirm later this year. That’s what Apple said in its update.

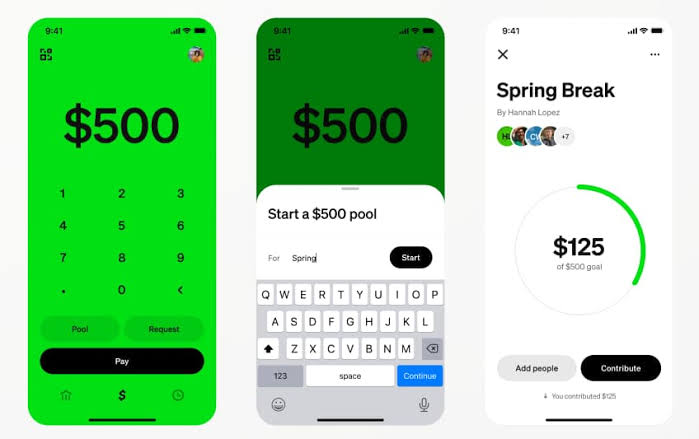

“This provides users with additional payment choices and offers the ease, convenience and security of Apple Pay alongside the features users love in Affirm – flexibility, transparency and no late or hidden fees,” Affirm wrote in an email.

Read also: Apple plans to add Gemini AI to Iphone

What makes Affirm’s Boost a game-changer for shoppers?

Buy now, pay later companies like Affirm benefit from the move. Last year, Apple launched its BNPL product, worrying investors it would crowd out Affirm. However, Apple’s inclusion of Affirm products shows that the fintech company has something unique.

Affirm’s loans can be repaid over a year, unlike Apple’s BNPL loan, which allows four payments over six weeks. The companies should have disclosed new loan terms.

“In our view, Affirm’s strong brand and sophisticated underwriting technology have a moat that Apple likely could not replicate,” Mizuho Securities analyst Dan Dolev wrote in a research note.

Apple Pay Introduces Installment Loans

It was also announced that Apple Pay users in the U.S. could get instalment loans through credit and debit cards issued by Citigroup, Synchrony, and Fiserv. After becoming very popular during the COVID pandemic, traditional credit card companies have started to offer instalment loans in the style of BNPL.

In an email, Synchrony said it was planning personalised instalment loans with deals based on the size of the transaction and the merchant involved. These deals could include lower interest rates and longer loan terms.

Read also: Apple creates “Two-Tier” iPhone experience with iOS 17.4 Update

“This announcement with Apple gives Synchrony a chance to expand our flexible payment options and give our merchants the chance to grow their presence in a growing mobile payments ecosystem,” said Mike Bopp, chief growth officer of Synchrony, in an email.

Around the world, more than 500 million people use Apple Pay. In the U.S., Apple Pay has the largest market share for its mobile payment and digital wallet platform.

On Tuesday, Affirm stock went up 11%, and Apple stock went up 7.3%.

Even though Affirm said it would take time for the partnership to make a big difference in its revenue, the company’s stock went up.

“Affirm does not expect this partnership to have a material impact on revenue or gross merchandise volume in fiscal year 2025,” it said in its filing.