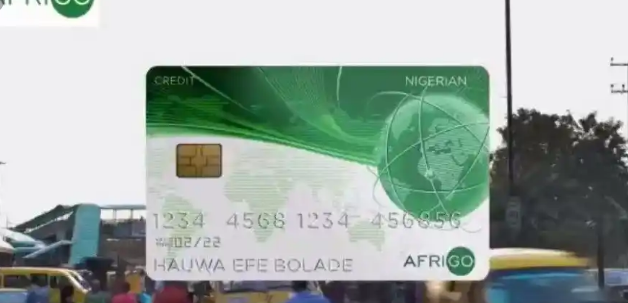

On January 26, 2023, the Central Bank of Nigeria (CBN) introduced a domestic card scheme known as AfriGo to compete with international cards such as Mastercard and Visa. With this move, the bank hopes to advance its initiative to make Nigeria a cashless society and save the country money on fees associated with international transactions.

Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), made the announcement following the bank’s decision from the previous year to eliminate older banknotes with greater denominations gradually.

The Governor of the Central Bank of Nigeria (CBN) stated during the virtual launch of the “AfriGo” card system that despite the fact that the use of card payments in Nigeria has increased over the years, many citizens are still unable to participate.

Emefiele said, “The challenges that have limited the inclusion of Nigerians include the high cost of card services as a result of foreign exchange requirements of international card schemes and the fact that existing card products do not address local peculiarities of the Nigerian market.”

Read also: Africa’s Yellow Card launches “Yellow Pay” services

The Impact of AfriGo

Emefiele stated that Nigeria would be joining China, Russia, India, and Turkey in implementing a domestic card scheme. AfriGo is owned by the Central Bank of Nigeria (CBN) as well as Nigerian banks.

He went on to say that international card services providers such as Mastercard and Visa will not be prevented from operating in Nigeria.

“Rather, it (AFRIGO) is aimed at providing more options for domestic consumers whilst also promoting the delivery of services in a more innovative, cost effective and competitive manner,” he added.

The majority of people in Nigeria, the country with the most inhabitants on the African continent, still conduct their financial transactions using cash since they reside in rural areas in which there are no banks.

Early Announcement

On Friday, October 21, 2022, the Central Bank announced to the public during a press briefing hosted by the Bankers’ Committee that the Central Bank of Nigeria (CBN) will begin accepting applications for its domestic card scheme (Afridi) on Monday, January 16, 2023.

Premier Oiwoh, Managing Director of Nigeria Inter-Bank Settlement System Plc (NIBSS), highlighted at the press conference that the domestic card scheme would cut the running expenses of cards in the country while also assisting the country in achieving its goals regarding financial inclusion.

The card is anticipated to improve data sovereignty in Nigeria. In addition to easing the transition to a cashless economy, it would also help facilitate. According to a statement released by the Central Bank of Nigeria (CBN), the rapid expansion of Nigeria’s payment landscape enables the government to initiate a domestic card programme.

Why Nigeria is Issuing a Domestic Card Scheme (AfriGo)

One of the goals of the new card system is to cut down on the expenses associated with running credit and debit cards in the country, which will benefit both card issuers and customers.

The apex bank also cited the fact that this would facilitate financial inclusion as a justification for their position. Because banks will have fewer operating costs, they will be able to drop the fees they charge for issuing cards, which may lead to an increase in the number of people who use cards. The cost that banks charge to issue debit cards presently may be drastically reduced in the near future.

Also, financial institutions would never have to deal with forex issues because payments to the card payment scheme would be paid in naira. This could provide some relief to the country as it deals with a severe shortage of forex at a time when it is desperately needed.

The card payment scheme

A payment network that handles transactions carried out using debit and credit cards is referred to as a card payment scheme. Visa and Mastercard are two of the most widespread and widely used card payment systems all over the world. Generally speaking, financial institutions like banks and credit unions will sign up for a card payment system in order to be able to issue credit cards to their consumers for a charge.

The services of a card payment scheme are required not just by financial institutions but also by other types of businesses. These services may be required by any company that plans to provide their clients with credit or debit cards. A grocery store that offers a customer loyalty programme may, for instance, hand out punch cards to repeat buyers. On the other hand, it is highly likely that a financial institution will stand behind these cards.

With the introduction of a domestic card payment system, Nigeria will be in the same league as other countries, such as India, Brazil, and Turkey, which all have their own domestic card payment systems.