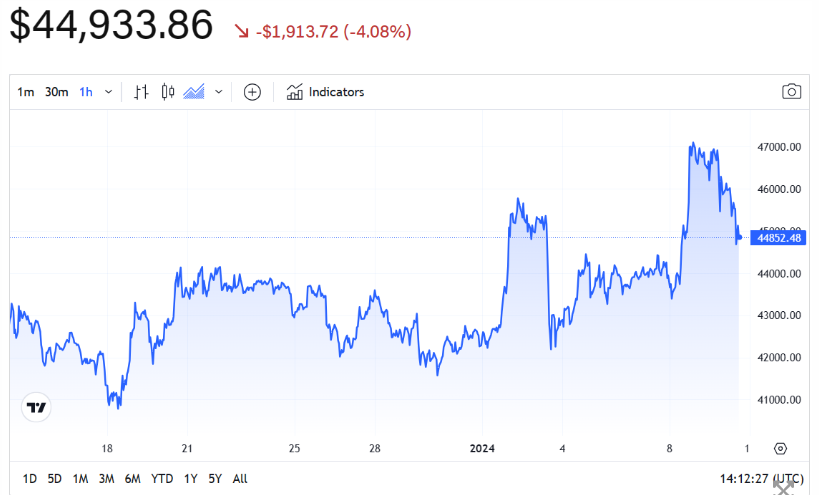

Bitcoin’s (BTC) price experienced a dip from $46,713 to around $45,000 on January 8 as excitement around the potential approval of exchange-traded funds (ETFs) injected fresh volatility.

The cryptocurrency displayed close to a 3% daily gain, with traders increasing open interest in what was described as a speculative move.

The buzz around ETF approval, particularly the anticipation of a decision on Wednesday, prompted traders to engage in speculative activities. Analysts warned of a potential market flush, as whales aim to shake out weak hands and purchase at lower prices. This follows last week’s liquidations that significantly reduced open interest, mainly due to unwinding leveraged long BTC positions.

Bitcoin futures open interest, at the time of writing, reached 407,400 BTC, marking an increase of more than 8,000 BTC for the day. Financial commentator Tedtalksmacro questioned whether this surge in open interest hinted at an early ETF decision.

Read also: Crypto market recovers to Pre-Terra Levels as Bitcoin Soars to $42K

Bitcoin Community Caution and Price Moves

Despite increasing confidence in ETF launches, well-known figures in the Bitcoin community maintained a cautious tone. Hodlonaut, an adviser to Bitcoin custody service The Bitcoin Advisor, expressed anticipation of further unreliable price movements surrounding the ETF decision.

James Van Straten, a research and data analyst at crypto insights firm CryptoSlate, noted a 1% price decline for gold, speculating on a potential rotation of market participants into Bitcoin.

As the U.S. Securities and Exchange Commission (SEC) approaches a decision on spot Bitcoin ETFs, multiple applicants, including Valkyrie, WisdomTree, BlackRock, VanEck, Invesco, Galaxy, Grayscale, ARK Invest, and 21Shares, filed their final S-1 form amendments on January 8. Several applicants included lower fees, intensifying competition in the ETF market.

Bitwise stands out with no fees for the first six months and the first $1 billion in assets, followed by a 0.24% fee. ARK Invest and 21Shares also offer no fees for the initial six months or until $1 billion in assets, with a subsequent fee of 0.25%. On the higher end, Valkyrie has an 0.80% fee, while Grayscale reduced its fee from 2% to 1.5%, currently the most expensive.

Analyst Eric Balchunas called the drop in ARK and 21Share’s fees from 0.80% to 0.25% “breathtaking,” signaling intense competition in the fee wars. However, experts caution that fee waivers historically haven’t significantly impacted market dynamics, with advisors often focusing on long-term investment perspectives.

Upcoming Decision and Market Expectations

With final amendments submitted, the next phase involves a vote by SEC commissioners, with market expectations forecasting the potential debut of the ETF around January 11. As the cryptocurrency community eagerly awaits the SEC’s decision, the market remains on edge due to the potential implications of ETF approval on Bitcoin’s price dynamics