A Sudanese Fintech Startup, named Bloom, has raised $6.5 million from its investors such as Y Combinator, GFC, and Visa to finance its operations.

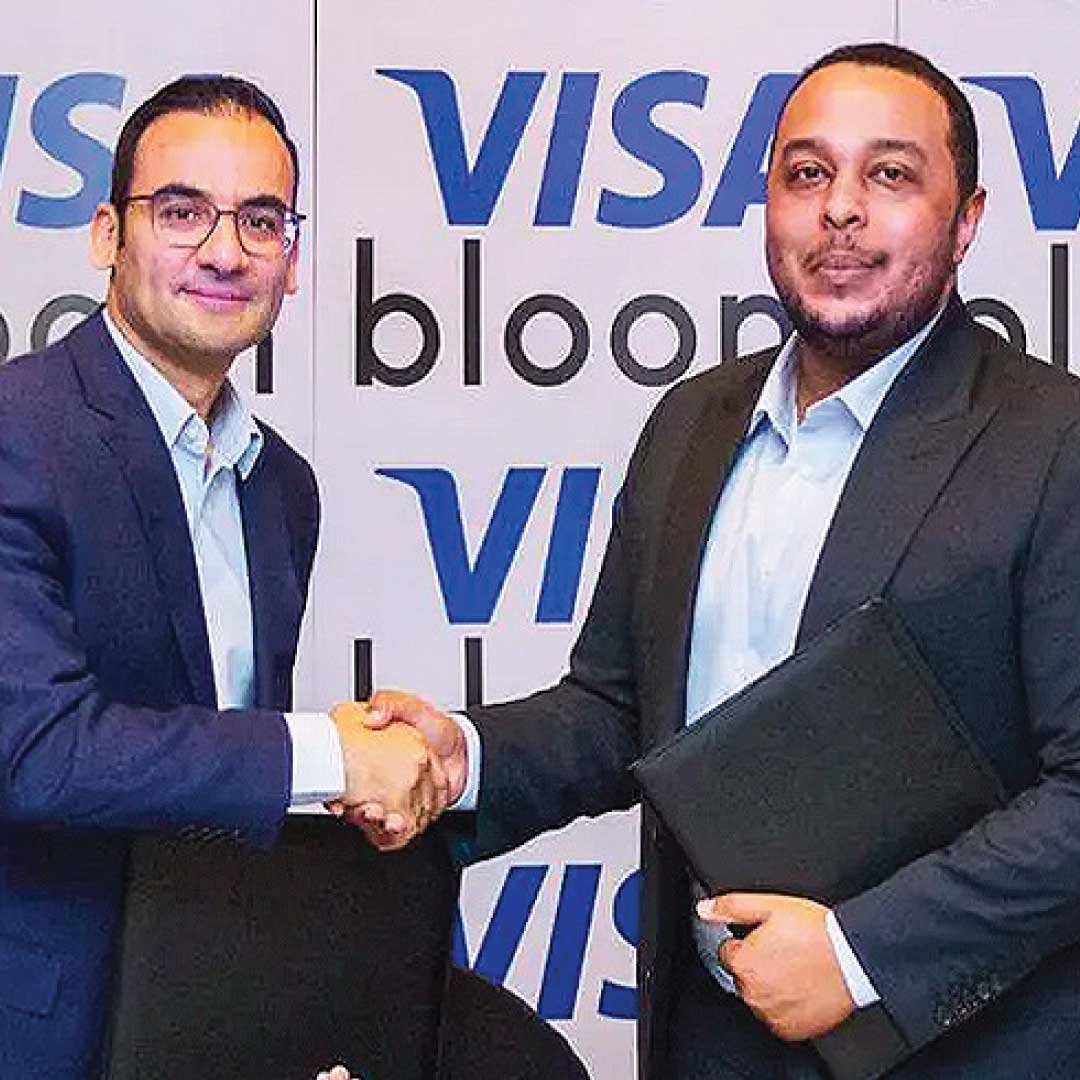

The Major investors who participated in this financing include Visa, Y Combinator, Global Founders Capital (GFC), Goodwater Capital, and VentureSouq. The funding from Visa came as an incentive for Bloom’s participation in the global card scheme’s Fintech Fast Track Program which prompted Bloom to form a partnership with them and change its card from Mastercard to Visa.

What The New Funding Means for Bloom

In an Interview with TechCrunch about the investment from Visa, the CEO, Ahmed Ismail said: “The Visa investment is critical for companies like us for a couple of reasons. One, aligning with Visa as a partner gives you a bunch of benefits, launching products faster, marketing support, and product support; and two, in addition to the investment, Visa Fintech Fast Track enables you to access these incentives in a streamlined way”.

In March this year, the company announced that it was part of Y Combinator’s winter batch after launching the platform officially and since the waitlist was released that year it showed that over 15,000 people had signed up to the platform at that time and in an interview with TechCrunch, the company founders stated that that number has topped 100,000 and it has being launched already in Sudan but refused to state how many users are actively using the platform.

Read Also : Ivory Coast Fintech Startup, Bizao Raises $8.2 Million For Expansion

The CEO of Bloom has stated that this funding will help the startup to execute its projects and expand to other parts of the Anglo-East African region to countries like Ethiopia, Kenya, Rwanda, Tanzania, and Zambia.

In a statement, Ismail said: “Our product is live in Sudan. The plan is to scale in the country and then expand to other markets. We anticipate being in at least one market before the end of the year and a couple earlier next year”.

The Highest In The History of Sudan Tech Ecosystem

Presently, The funding received by Bloom is the highest in the history of Sudan as the country’s tech ecosystem is considered passive and repellant to foreign investors and only recently accepted foreign investors when Fawry, a Fintech industry, and e-commerce player Alsong came along- the country has been the recipient of international sanctions for 30 years.

Sudan is located in the eastern part of Africa and has over 500 million inhabitants but the region’s currencies including that of Sudan are prone to depreciation as every year the Sudanese depreciates 15% more to $1. This is why startups such as Bloom and people such as Ismail, Khalid Keenan, and Abdigani Diriye are present to help individuals of that country and region fight against the rising devaluation.

Bloom Mission

Bloom as part of its objectives to get more users on its platform offers fee-free accounts for its users to save in dollars and transact in Sudanese Pounds. They also provide either Local cards or Dollar cards which will enable the users to receive remittance free of charge from several countries worldwide and this helps Sudanese nationals in the diaspora.

They are also in partnership with Export Development banks who helps them in handling their deposits and this generates revenue for Bloom as they charge interest on these deposits, the interchange, and other ancillary streams.

On both sides, Visa and Bloom executives consider their partnership as one which will be very profitable for both and it will also provide for the adoption of Visa cards in Sudan and the entire Eastern region of Africa which will provide users which will provide users with a fast and secure way to perform transactions online.

Read Also : Ubenwa Secures $2.5M to Help Parents, Clinicians Interpret Baby Cries

In a statement, the Visa country general manager for Sudan and Libya, Ahmed Mohey, said: “Visa is taking the lead as a first mover in digital payments in Sudan. Ware is committed to being a part of Sudan’s economic transformation by bringing our global expertise and capabilities to its government and private-sector partners.

Together with Bloom, we will continue to drive acceptance of digital payments while finding opportunities to launch new products and services to Sudanese customers and merchants”.

Also, Roel Janssen, a partner at Global Founders Capital said: “We are very excited by our investment in Bloom.

Its experienced and talented founding team has the drive and expertise to build a product that is universally valued by consumers, partners, and regulators in Sudan and the wider East Africa region”.

How Startups Have Helped Developing Countries Grow Their Economy?

This can be narrowed to “The benefits of startups to an economy”, As we all know startups are founded by entrepreneurs who aim to solve a problem in society. Most startups are known to spring up faster in a developing economy where entrepreneurs aren’t that popular to make an impression in that economy and hence make a profit. Here are the benefits of having a startup in a developing economy:

i) Creation of Jobs:

This is the most important impact a startup makes on an economy because with the creation of more startups in a country there will be vacant positions that will need to be filled up by persons hence taking youths out of the streets and into the office or industry. This will help to curb the crime rate as most of them will be too busy to commit crimes because of their workload of them.

ii) Creation of Wealth:

Startups mean the coming of more investors who are interested in their projects which means they will be invested in our country which creates wealth for the economy and betterment of the citizens’ lives.

iii) Increase the GDP:

GDP which means Gross Domestic Product is a vital role if an economy is expected to excel. By supporting startup creation and the influx of investors in the country it will prompt the GDP to rise which will increase the revenue generated by the country hence the betterment of the economy.

Conclusion

Startups play a huge role in boosting the economy of any nation. The step Bloom has taken will have a positive impact on the economy of Sudan and the Anglo-East regions of Africa as a whole. It is worthy to note that Bloom couldn’t have obtained all this without the involvement of investors, and the partnership with Visa.