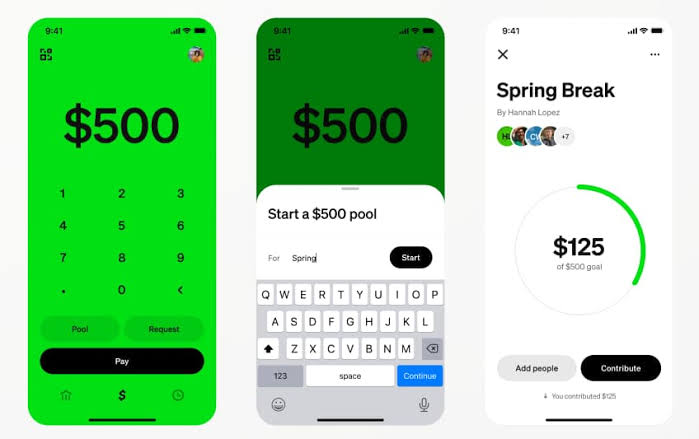

Cash App revealed on Tuesday a new feature called Pools that lets users easily collect money from groups for shared expenses, including people who don’t have Cash App accounts. This bold step changes how group payments work by enabling users to invite contributions from Apple Pay and Google Pay users outside the Cash App network.

How pools simplify group payments

Pooling money is now straightforward with Pools. Organisers can create a pool by setting a name and target amount, then invite friends or family to contribute effortlessly. Contributions come from Cash App users and those using Apple Pay or Google Pay, allowing easy participation without multiple apps or confusing payment methods.

Cash App’s Head of Product Design, Cameron Worboys, said, “With pools, our customers now have a dedicated, easy-to-use solution for group payments: they can start a pool to collect the money in seconds, and then instantly transfer the funds to their Cash App balance when it’s time to pay.” This solves the common problem of one person fronting the entire cost before everyone else pays back.

Tracking progress is no hassle either; organisers can see how much has been collected and who has paid, removing guesswork and reducing stress. This feature is perfect for vacations, shared gifts, group events, or any situation requiring shared expenses. Pools integrate seamlessly with Cash App’s banking and payment tools, letting organisers quickly use the funds collected without delay.

Extending payments beyond the app

A standout aspect of Pools is its ability to accept contributions from non-Cash App users. This is the first time Cash App has enabled out-of-network payments with this level of ease.

Block’s business head, Owen Jennings, said, “This product is fundamentally designed for network expansion and enhancing the virality of our peer-to-peer offerings.” By inviting Apple Pay and Google Pay users through a shareable link, groups can gather funds from anyone, reducing the need for all participants to download Cash App and expanding its reach.

Pools are currently available to select users with a planned gradual rollout. Cash App views this innovation as a way to deepen engagement and grow its large monthly active user base by making group money management more social and accessible.

With Pools, Cash App reshapes how people collaborate financially within groups, eliminating the confusion and delays traditionally involved in collecting money for shared costs. The launch on Tuesday marks a significant update to peer-to-peer payments by merging convenience, social connections, and wider accessibility.