MARA, a Pan-African crypto platform, announced completing a seed round of $23 million in equity and token sale from a pool of investors. They include high-profile crypto and web3 investors such as Coinbase Ventures, Alameda Research (FTX), and Distributed Global.

Other VCs in the round include TQ Ventures, DIGITAL, Nexo, Huobi Ventures, Day One Ventures, Infinite Capital, and DAO Jones (investment DAO backed by Mike Shinoda, Steve Aoki, and Disclosure), while about 100 other crypto investors also participated.

Developing Products To Serve Diverse Crypto Finance Needs

Sub-Saharan Africa is the third-fastest growing cryptocurrency economy as data from blockchain intelligence firm Chainalysis says the region’s crypto usage grew 1,200% in 2021.

However, despite the proliferation of local and international crypto exchanges, as well as the introduction of unique models by up-and-coming web3 platforms, some observers believe that there are still significant impediments to crypto adoption in Africa.

As a result of this introspection, startups like MARA have emerged with the goal of “increasing the number of Africans who can engage in the crypto economy.”

MARA says it is developing a suite of products for the African market to serve diverse crypto-finance needs. Its main product is a crypto-brokerage app for consumers that allows them to buy, send, sell, and withdraw fiat and crypto-assets. The company plans to launch in Kenya and Nigeria, where it is located, in July of this year.

Read Also : Draper Startup House Launches in Zambia in Partnership with BongoHize

Though MARA maintains that consumers don’t need any prior crypto knowledge to use this retail app, local options like VALR and Yellow Card, which are supported by Coinbase Ventures, are abounding in Africa. However, the web3 upstart’s subsequent products may make it stand out.

In Q4 this year, it will launch the MARA Chain, a layer-1 blockchain and Alchemy-Esque platform powered by the native MARA token for developers to build decentralized applications — also known as dApps — in Africa. Then sometime in Q1 2023, MARA intends to launch a pro-exchange for sophisticated traders that utilize technical analysis and prefer a full set of trading options to the traditional exchange options on MARA’s retail app.

Explaining MARA’s unique selling proposition, co-founder and CEO Chi Nnadi says, “We’re creating financial infrastructure for people to build their lives. And so it’s more than just being able to buy crypto; it’s about African engineers creating their [own] projects. We want to be the source for incubating talent; we want to give them the platform through our exchange to launch their projects.”

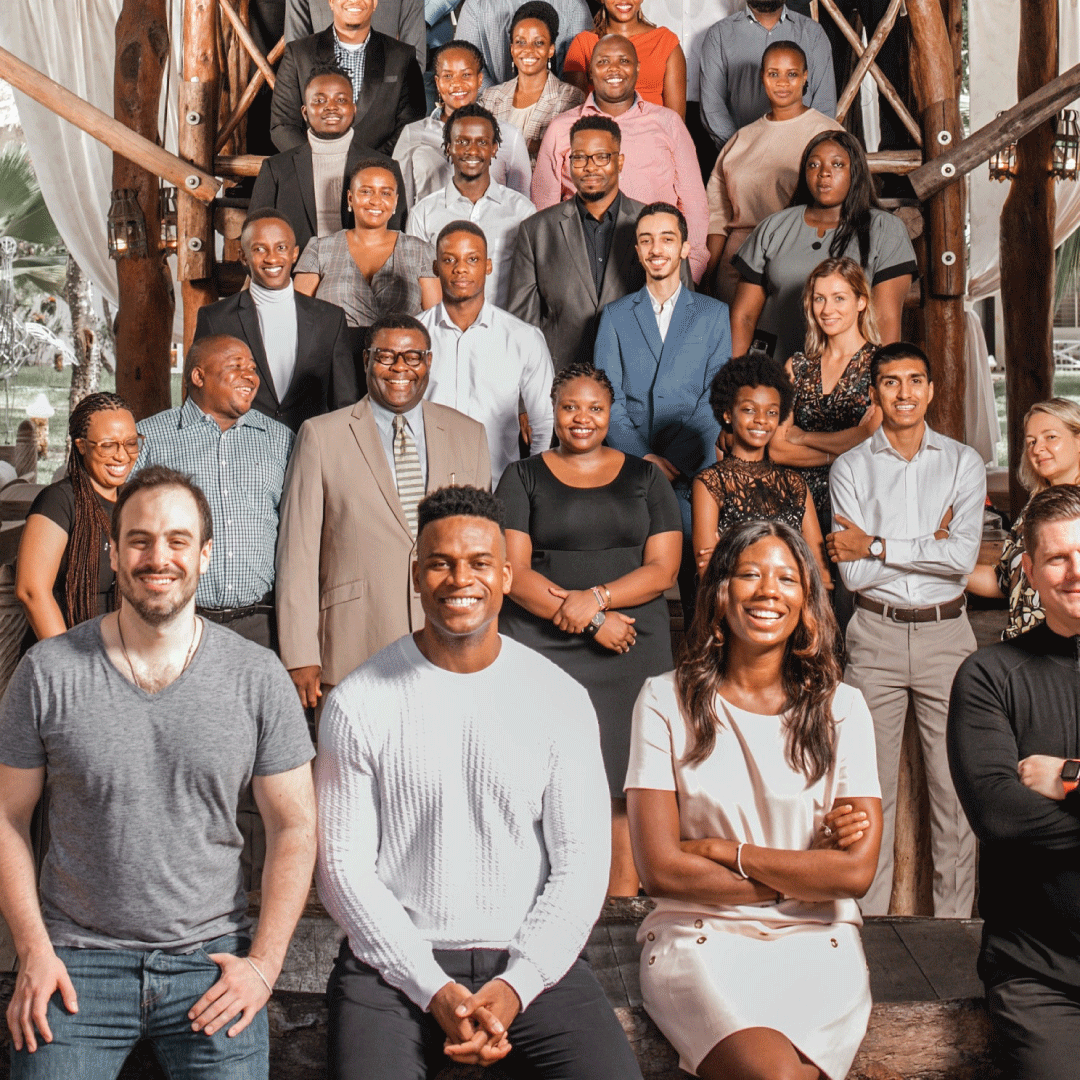

Nandi founded the company in April 2021 with an executive team that includes Llinás Múnera, Dearg OBartuin, Kate Kallot, and board advisors Kojo Annan and Tatiana Koffman. They are former executives from Amazon, PayPal, Uber, Nvidia, Founders Bank, and Rappi.

Bringing About Mara

Before MARA, Nnadi was the executive director of Sustainability International, a nonprofit that handled community-led solutions to the UN Sustainable Development Goals. While commuting between Nigeria (his home country) and the United States, he became aware of the sociological and financial issues that Africans in remote areas face, as well as notions about how bitcoin and blockchain technology could help.

“Instead of understanding blockchain technology specifically for its utility within the African context, there’s an opportunity to use it as a foundational trade technology to make sure capital got to people’s hands and last mile.”

Read Also : EDTECH Startup Manara Raises $3M To Grow Tech Talent Pool In MENA

The Sustainability International team worked on a project with Consensys, which birthed the design of Sela Technologies. It was a platform that enabled direct payments and distributed accountability — via smart contracts — to stakeholders in a development project.

“We were involved in really bringing blockchain technology to the woman in the market and the last mile. And so it was working on that that I started to realize we needed wallets, exchange, and core infrastructure for crypto in Africa,” Nnadi revealed, describing what led to the formation of his web3 startup, MARA.

A few web3 and decentralized platforms, such as Nestcoin (funded by Alameda Research) and Jambo (backed by Coinbase Ventures), have made their way into Africa over the past year, promising to onboard millions of users into a new economy while also benefiting them. Although their combined impact is yet to be noticed, this may change with time.

Mara Poise For Immediate Impact

MARA, on the other hand, seeks to have an immediate impact. The startup revealed in a statement that it had formed a partnership with the Central African Republic (CAR), which was the first country in Africa to legalize bitcoin as legal tender and is only second in the world to El Salvador to become its official crypto partner and a crypto advisor to the president.

“We’re there to advise the president on improving their technology infrastructure so that they can bring on widespread crypto adoption. So that means advising them to expand internet access and mobile phone adoption and working in an advisory capacity since they’re the first African country to adopt bitcoin.”

While there is widespread grassroots cryptocurrency adoption in most parts of Africa, Nnadi claims it occurs without oversight. MARA intends to educate governments and support KYC and AML best practices as a “legalized exchange.” The partnership with CAR makes one of the first steps the web3 platform will take a reality — assisting the government in establishing a national ID campaign and then implementing KYC/AML standards in tandem with crypto education and financial literacy.

“The government is working through multi-year multi-step processes that will allow them to address infrastructure issues. And then, once those infrastructure challenges have been addressed, it’ll be quite easy for folks to use the Mara wallet,” Nnadi remarked.

Nnadi says his startup intends to engage more African governments — including those with an anti-crypto stance like Nigeria and Kenya — to see the benefits of blockchain and offer a hand in drafting licensing regimes for crypto companies to operate in their countries.

It’s unclear how MARA plans to reason with these governments, whose reputation for toughness precedes them; yet, only time will tell what results from such dialogues. For the time being, the year-old company will be basking in what is perhaps the most significant financing for an African crypto/web3 startup at this level.