Nigerian fintech CredPal has collaborated with Bolt to let users “ride now and pay later.” Credpal created the agreement to simplify credit financing for customers and boost its buy-now-pay-later products.

By signing up on the CredPal app and activating an option to pay for Bolt trips at the end of the month or at any convenient date when they are financially stable, users can use the CredPal Ride-On function.

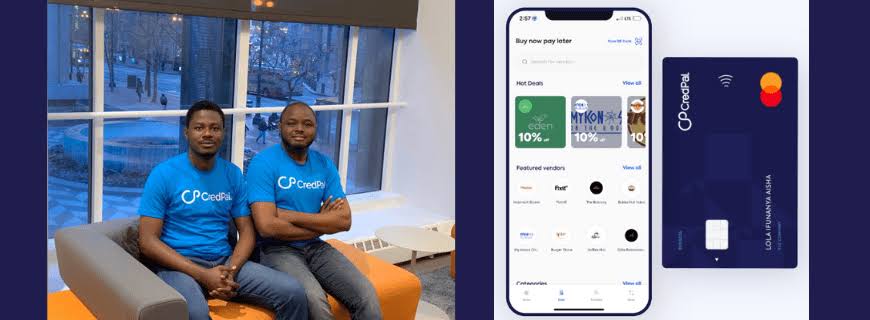

CredPal CEO and Co-Founder Fehintolu Olaogun said the service would improve money management for Nigerian wage earners.

“I think transportation is one of the daily necessities that a working Nigerian takes into account when making a monthly budget. “With CredPal Ride-On, we’ve given them the option to use the credit they’ve been given to better manage their monthly expenses.”

Kwaku Ampadu-Manu, the country sales manager for Bolt, said that Ride-On is a necessary product that could help speed up the use of digital payments and give Bolt riders another way to pay.

“This partnership gives riders access to a much-needed way to get around that doesn’t cost them money right away, and we’re happy to work with CredPal to help us reach our goal of making cities for people, not cars.”

Read also: Bolt Expands Its Operations in Ghana with the Addition of Tamale

How is the service operated?

Users must register on the CredPal platform in order to access this and have it pay for their travel expenses.

They can then enable an option to pay for their Bolt trips at the end of the month by selecting CredPal as a payment method. Additionally, users have the option of choosing Ride-On, which enables flexible repayment during the recipient’s income period.

The effects on Nigerians

The growth of buy now, pay later (BNPL) businesses over the past three years has been among the startup landscape in Nigeria’s most positive developments. Most of these businesses allow clients to buy products and services that they would otherwise have to put off for months. It should come as no surprise that Nigerians embraced it right away.

Thanks to these BNPL models, Nigerians will be able to use ride-hailing services even if they don’t have cash and can pay whenever it’s convenient. This will increase the revenue of the ride-hailing businesses as well, benefiting both sides.

Bolt Launches Vehicle Financing Scheme in Ghana To Encourage Automobile Ownership

How does it impact both CredPal and Bolt

Through this service, Bolt might gain more customers, while CredPal could improve the number of times its app is used as a payment option.

The service is currently only available to people who have registered on CredPal because the startup is paying for their travel expenses. Users do not, however, have to pay a portion of their fare during the ride, unlike ordinary BNPL offers.

Alternatively, they can select CredPal as a payment method and pay for the ride at the end of the month. Users are pre-qualified for Ride-On based on particular criteria, just like for its standard BNPL offer, and repayments are timed to match the user’s income date.

CredPal may be the first third-party company in Nigeria to offer a “ride now, pay later” option, but this isn’t the first time a startup has provided its customers with this service. In 2016, the Indian ride-hailing business Ola unveiled a credit option that let customers book rides for up to seven days without paying in advance. Similar to this, GoCatch, an Australian ride-hailing company, included Zip, a BNPL service, as a mode of payment.