Epic Pay has unveiled a comprehensive strategy aimed at elevating Africa’s financial infrastructure through developer-focused APIs, biometric payment innovations, and AI-driven fraud prevention, signalling a new chapter for digital finance across the continent.

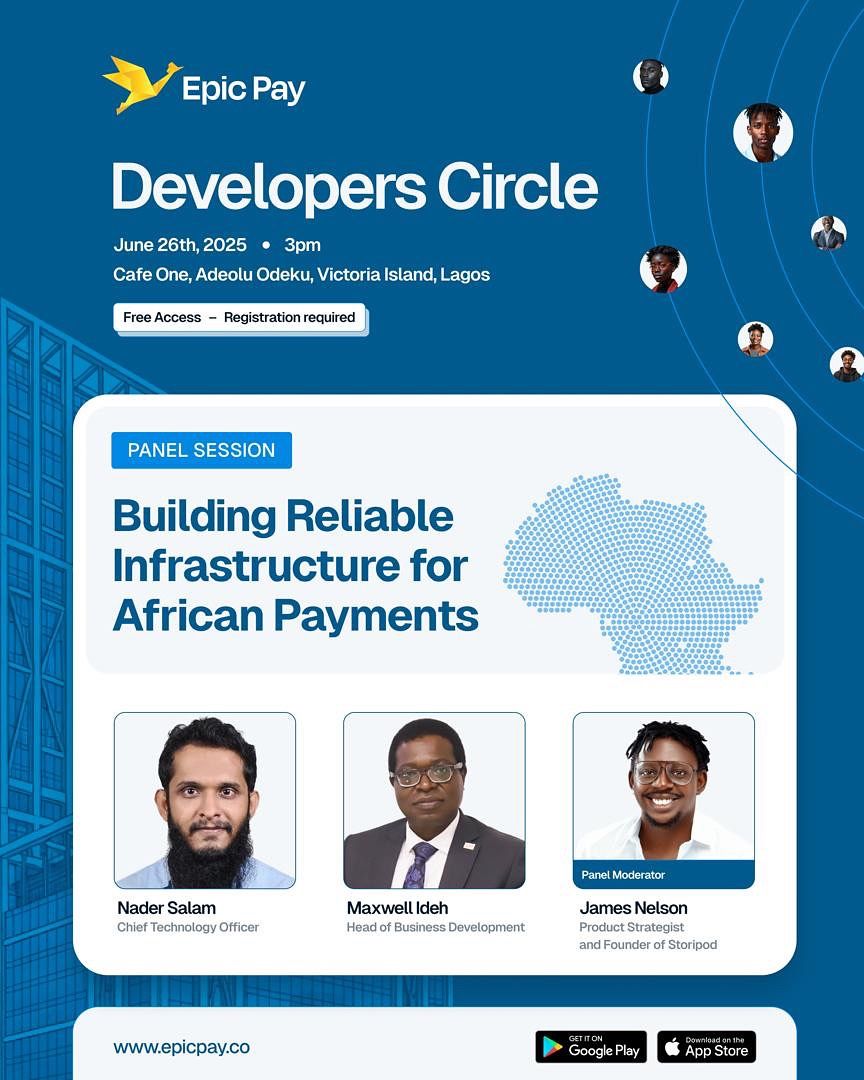

On Thursday, Café One VI in Lagos hosted an exclusive event for developers, product strategists, and fintech enthusiasts at the Epic Pay Developers Circle. Organised by Epic Pay, the mixer went beyond networking, offering hands-on insights into the technologies and systems shaping Africa’s financial landscape.

A vision anchored in trust and growth

Maxwell Ideh, Head of Business Development at Epic Pay, opened the session by sharing the company’s 40-year journey grounded in trust, security, and compliance. Highlighting their ISO 27001 certification, Maxwell described how Epic Pay’s APIs serve a diverse ecosystem—from startups to large institutions—facilitating seamless integration and financial innovation.

Maxwell emphasised Epic Pay’s mission to elevate Nigeria’s financial infrastructure by providing developer-friendly tools that unlock growth opportunities across sectors. He believes that collaboration between developers, platforms, and financial institutions is the key to unlocking untapped revenue opportunities and expanding digital finance access.

Nader Salam, Epic Pay’s Chief Technology Officer, led a live session showcasing how developers can log into the Company’s web application and utilize its APIs for payments and integrations. With step-by-step guidance, Nader walked the audience through real-time use cases, encouraging the community to tap into the ease and speed of building with Epic’s platform. His session was hands-on, practical, and indicative of Epic Pay’s commitment to empowering the developer ecosystem.

Panel session: Building reliable infrastructure for African payments

The first panel session, “Building Reliable Infrastructure for African Payments,” saw Nader and Maxwell explore current realities and future ambitions. Nader revealed a fascinating 10-year outlook that includes face-pay, palm-pay, and retina-scan payment systems. These biometric advancements aim to introduce faster, more secure payment options while reducing dependence on physical cards or devices.

Maxwell discussed Nigeria’s financial inclusion rate, currently at an estimated 30–35%, and boldly envisioned a leap to 90% in the next 5 to 10 years. He projected that offline transactions—payments made without an internet connection—would soon become standard, enabling underserved and remote communities to participate fully in the digital economy.

The second panel turned to artificial intelligence and fraud prevention. Maxwell and Nader discussed how Epic Pay develops customer-specific AI models that analyse behavioural patterns to predict and prevent fraudulent activity. Rather than rely on blanket rules for suspicious transactions, Epic Pay is using machine learning to personalize alerts and security triggers based on how each customer interacts with the platform—how much they typically spend, how often, whether they are savers or spenders.

Dapo, a specialist in risk and compliance, added critical insights. He emphasised how their AI models are trained to spot red flags like high-value deposits into newly created, minimally verified accounts. This kind of transaction pattern would immediately trigger a Post No Debit (PND) flag, freezing the account from withdrawals while further investigation occurs. According to Dapo, such systems are vital in proactively catching fraudsters and maintaining trust in digital finance.

Open Banking and instant innovation

Another key highlight was the discussion on open banking—a model under which Epic Pay operates. Through open banking, loan processing and fund transfers can happen faster by removing traditional verification bottlenecks. Instead of waiting weeks for banks to review six-month statements, open banking connects directly to a customer’s financial data in real time, leading to faster approvals and more responsive financial services.

The audience was also excited by talk of instant payment reversals, a consumer-centric approach that allows transactions made in error to be quickly corrected—something increasingly demanded by users today.

A glimpse into the Future

Epic Pay Developers Circle wasn’t just a celebration of code or APIs—it was a call to action. It was a moment where real developers met real systems and imagined a future where secure, inclusive, and intelligent financial systems serve everyone—from urban businesses to rural markets.

As Africa continues to rise in the fintech space, platforms like Epic Pay are leading the charge, showing that the continent’s biggest payment breakthroughs may not lie in catching up, but in building something new entirely.