On Monday, Flend, a pioneering tech start-up, announced that it has secured the first-ever Digital Non-Banking Financial Institution (NBFI) licence from the Financial Regulatory Authority (FRA) in Egypt.

This milestone positions Flend as a key player in financing small and medium enterprises (SMEs) in the region.

Read also: Flend becomes the first SME non-bank digital financial institution in Egypt

Founder and vision

Founded by visionary entrepreneur Marcia Mandisi Mabaso, Flend aims to revolutionise how SMEs access financial services.

Mabaso, who has a rich background in entrepreneurship and media, expressed her excitement about this achievement: “This licence is not just a regulatory milestone; it’s a commitment to empowering local businesses and fostering economic growth”.

Impact on SMEs

With this new licence, Flend plans to offer tailored financial solutions designed specifically for the unique challenges SMEs face in Egypt.

The company’s innovative approach focuses on leveraging technology to streamline processes and enhance accessibility for business owners.

Mabaso emphasised the importance of supporting SMEs: “These businesses are the backbone of our economy; they deserve every opportunity to thrive”.

Flend’s initiative reflects a broader trend in the fintech sector, where technology is increasingly harnessed to improve financial inclusion.

Flend is helping both individual company success and Egypt’s economy as a whole by attending to the unique demands of SMEs.

Read also: Beltone expands into African financial services with acquisition of Baobab Group

About Flend

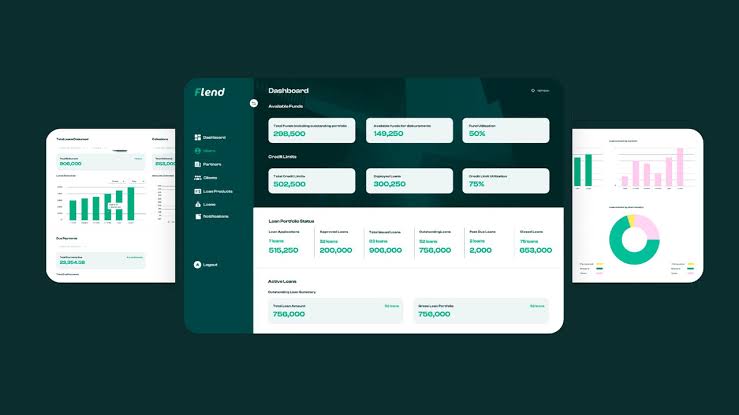

Flend is a platform designed to facilitate peer-to-peer lending. It allows individuals to lend and borrow money directly from each other without the involvement of traditional banks. Flend aims to create a more accessible and efficient lending process, often offering lower interest rates for borrowers and better returns for lenders.

Users can set their terms, including loan amounts and repayment schedules, promoting financial inclusion and empowering individuals to manage their finances more effectively. Flend prioritises transparency and community trust in its operations.