In the fast-paced world of startups, brilliant ideas and innovative products are only part of the equation for success. The missing link, often overlooked, is financial discipline—a critical factor that can make or break a company’s ability to secure funding and sustain growth.

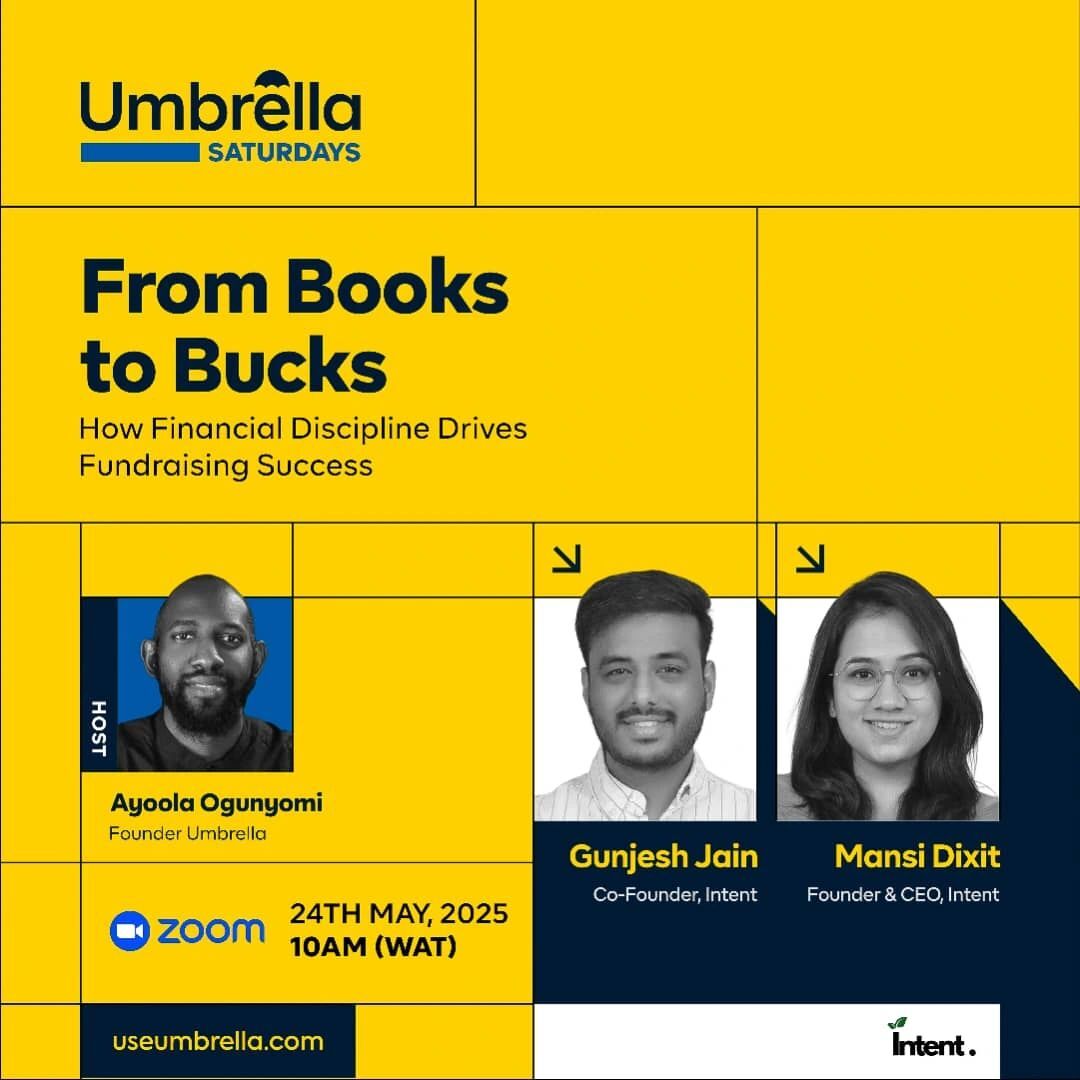

This was the central theme of the Umbrella Saturday Webinar, hosted by Ayoola Ogunyomi, CEO and founder of Umbrella, on May 17.

The virtual event, titled “From Books to Bucks: How Financial Discipline Drives Fundraising Success,” brought together founders, investors, and ecosystem advisors to dissect the financial challenges startups face and how proper bookkeeping, financial clarity, and strategic planning can pave the way for successful fundraising.

Featuring insights from guest speakers Mansi Dixit and Gunjesh Jain, founders of Intent, a fractional financial management firm based in India, the webinar provided actionable strategies for startups at different growth stages.

Importance of financial discipline in fundraising

Ayoola Ogunyomi set the tone with his opening remarks, emphasising Umbrella’s mission as a platform for founders to gain mentorship, clarity, and access to investors.

“This is not just another webinar; it’s Africa’s most reliable digital gateway to early-stage deal sourcing, startup-investor matchmaking, and real-world expertise,” he said.

The discussion took a compelling turn when Mansi Dixit shared the story of Flutterwave, the African fintech giant that struggled with investor scepticism before refining its financial reporting.

“Flutterwave’s founders initially couldn’t answer basic investor questions on contribution margins or revenue recognition. But after six months of financial restructuring, they returned with clarity—raising $10 million in Series A, $35M in Series B, and eventually $470 million in total funding,” Mansi narrated.

The lesson? Investors don’t just bet on ideas; they bet on measurable and sustainable businesses.

Gunjesh Jain reinforced this, stating:

“Startups don’t fail because they can’t raise funds. They fail because they lack financial discipline. If you master your metrics, money will follow.”

Pitfalls of poor financial management

A recurring theme was the disconnect between the founders’ operational focus and financial oversight. Many early-stage startups neglect bookkeeping, assuming they can “remember the numbers.” Mansi debunked this myth with a Shark Tank-style simulation:

“Imagine pitching to investors without clean financial records. They’ll ask about TAM (Total Addressable Market), burn rate, or MRR (Monthly Recurring Revenue). If you fumble, the deal collapses—even if your product is revolutionary.”

Gunjesh added a real-world example from Nigeria, where a Series B-funded startup’s CFO struggled with inconsistent monthly reports.

“Numbers kept changing, meaning no one—not even the CFO—could trust the financial health of the company. That’s a red flag for investors,” he noted.

Another critical issue was founders mixing personal and business finances. Ayoola raised this concern, citing African startups where investor funds were diverted to personal expenses. Gunjesh responded:

“This isn’t unique to Africa. Founders globally undervalue their time. Once funded, they should pay themselves a salary, separating personal and business finances. A company isn’t a personal ATM.”

Fractional Finance: A flexible solution for startups

To address these challenges, Mansi and Gunjesh introduced fractional finance, a flexible, cost-effective model in which startups access financial expertise only when needed.

“Traditional finance is like buying a 10kg detergent when you only need a sachet,” Mansi analogized. “Fractional finance lets you hire a CFO, bookkeeper, or tax expert for specific tasks—no retainers, no full-time costs.”

This approach offers tailored financial support for startups across various stages of development. At the pre-seed or idea stage, the focus is on establishing basic bookkeeping practices and projecting cash flow.

As startups move into the seed stage, attention shifts to analysing burn rate, understanding unit economics, and preparing reports suitable for investors.

When startups reach the growth stage, they benefit from full audits, detailed revenue modeling, and strategic financial planning.

“We’ve worked with startups using just Excel sheets and others on Xero or QuickBooks. The key is consistency, not complexity,” Gunjesh added.

Mastering metrics to secure funding

The webinar closed with a networking session, where founders like Innocent Nwajohn and Jerah Aribor shared their financial struggles and opportunities. The consensus was clear: financial discipline isn’t optional—it’s the backbone of fundraising success.

As Mansi succinctly put it:

“Your books are the foundation. Clean them, understand them, and investors will trust you. Otherwise, even the best ideas crumble.”

For startups looking to navigate the complex world of fundraising, the message was empowering: Start small, stay disciplined, and leverage fractional finance to build a business that doesn’t just attract investors but retains them.

Ayoola’s closing remark encapsulated the session’s essence:

“Umbrella Saturday isn’t just about learning; it’s about transforming knowledge into actionable growth. Financial clarity today means funding success tomorrow.”