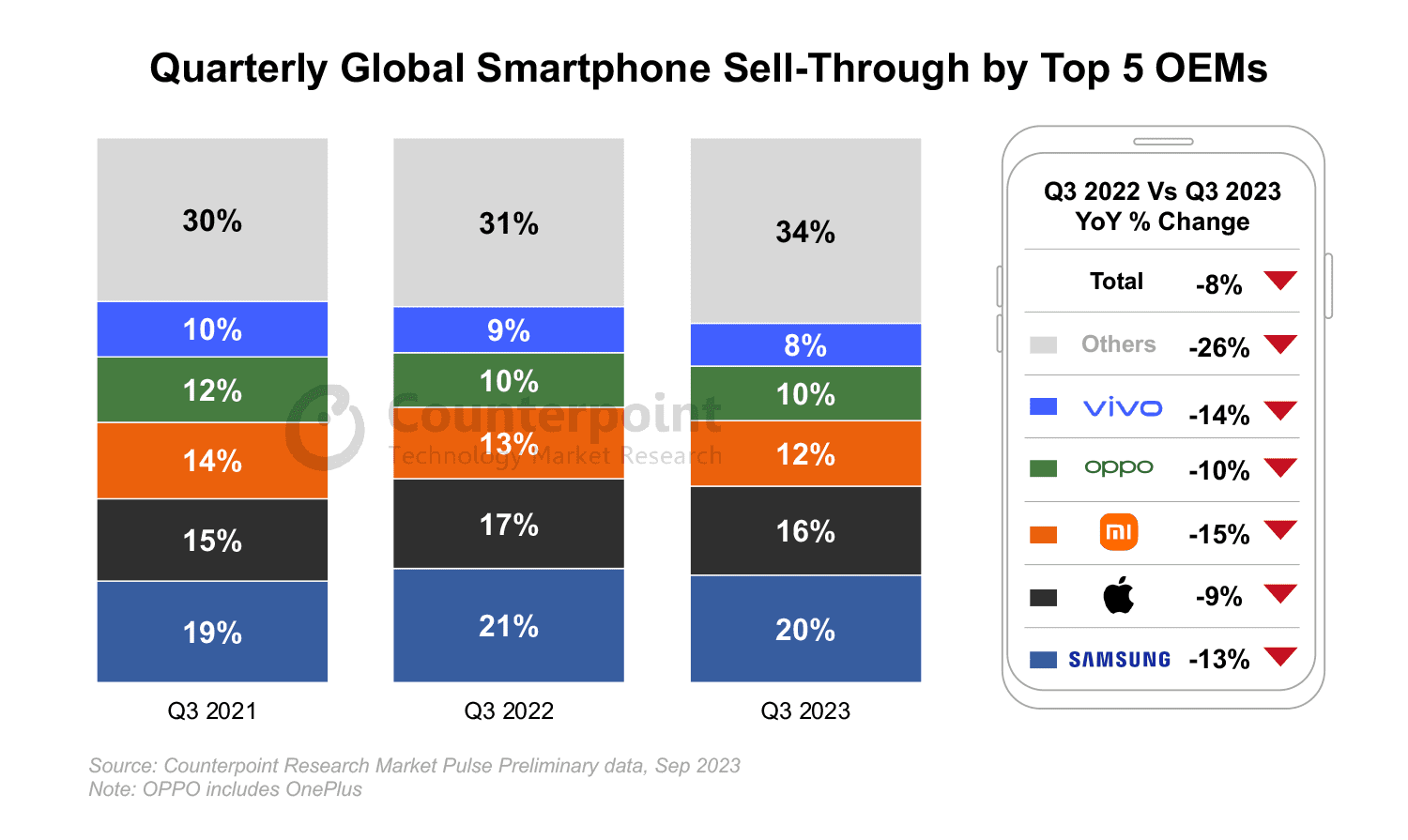

The global smartphone market is being confronted with severe difficulties. This is evidenced by the recently reported year-on-year (YoY) drop in sales volumes for the third quarter of 2023, which was 8%. Since the pandemic began, this is the seventh straight quarter in which growth has been slower than normal.

According to a report by Counterpoint, the protracted impact of the COVID-19 pandemic and the consequences of global wars, such as the Russia-Ukraine war on consumer demand, are reflected in the 8% YoY fall in worldwide smartphone sales volumes for Q3 2023. This decline was measured over the course of a year. The expansion of the market has been hampered as a result of a slower-than-expected recovery, which has led to the ninth consecutive quarter of contraction.

There is, however, a ray of hope with an increase of 2% from quarter to quarter, especially in light of the strong performance in the month of September. This points to the possibility that the market is on its way to making a comeback.

Despite a year-over-year decrease in sales volume of 13%, Samsung maintains its hold and leadership in the global smartphone industry, grabbing 20% of the overall sales in the third quarter. This highlights the power of its brand as well as the variety of products it offers. The ability of the corporation to appeal to a diverse group of customers is demonstrated by the fact that the Flip 5 has outsold its competitors and that models from Samsung’s A-series can be sold in price ranges that are considered to be middle of the road.

Despite the restricted availability of the iPhone 15 series, Apple maintained its position as the market’s second-place contender, earning a share of 16%. In spite of this limitation, the iPhone 15 series has been met with widespread acclaim. The continued success of Apple’s products can be attributed to the company’s strong brand recognition and appeal, which demonstrates the company’s ability to sustain its position in the market despite competitive pressures. According to the research, the number of sales that the company that makes iPhones experienced dropped by 9% year over year.

Read also: Starlink to introduce direct-to-phone connection in 2024

More brands witness sales decline

During the third quarter of 2018, HONOUR, Huawei, and Transsion Group were the only brands to increase their market share and record growth year over year. The introduction of Huawei’s Mate 60 series in China was a primary driver in the company’s expansion, while HONOR’s success in international markets was a significant one. The expansion efforts of Transsion Group, in conjunction with a rebounding market in the Middle East and Africa (MEA), demonstrate the company’s capacity to capitalise on possibilities in particular regions.

The smartphone manufacturers Xiaomi, OPPO, and vivo have all experienced difficulties, showing YoY losses in sales. This highlights how competitive the market for smartphones currently is. While these businesses are working hard to bolster their positions in important countries such as China and India, they are simultaneously modifying their strategies for expanding internationally in order to bring them into alignment with the shifting preferences of consumers and the conditions of the market.

There is clear evidence of regional dynamics in the smartphone market. In the third quarter, only the Middle East and Africa (MEA) region had year-over-year growth in terms of revenue. This was mostly the result of improved macroeconomic indicators, which include the drive towards implementing 5G internet infrastructure in these economies.

In contrast, the majority of developed markets, such as the United States of America, Western Europe, and South Korea, have experienced significant decreases. However, a rebound is expected in the fourth quarter, partly as a result of the delayed effect of the launch of the iPhone.

The shifting dynamics and prospects in the global smartphone industry are shown by the growth of brands that are not among the top five, as well as the recovery of emerging markets before the recovery of the global market. It also demonstrates the adaptability of the market to changing customer tastes and the possibility for new entrants to modify the landscape of the sector. Both of these points are highlighted by this point.

Expectations and projections

After a prosperous month of September, it is anticipated that the current momentum will carry on into the final three months of the year. The full impact of the iPhone 15 series, festive seasons in India, sales events in China, and end-of-year promotions are some of the elements that will drive this momentum. It is anticipated that the string of YoY reductions will come to an end in the fourth quarter of 2023, signalling a potential turning point for the industry.

In spite of these predictions, long-term forecasts indicate a further fall for the entire year of 2023, hitting its lowest level in a decade. This drop can mostly be ascribed to changing patterns of device replacement, particularly in developed economies. This pattern highlights the difficulties associated with sustaining the interest of consumers in an era dominated by smartphone technology.

If the smartphone market is to record a high performance in the fourth quarter, this would indicate that the expectations for things outlined above to contribute to its growth are significantly more significant than the current demand that is being driven by global tensions and the protracted impact of the Covid-19 pandemic on economies.