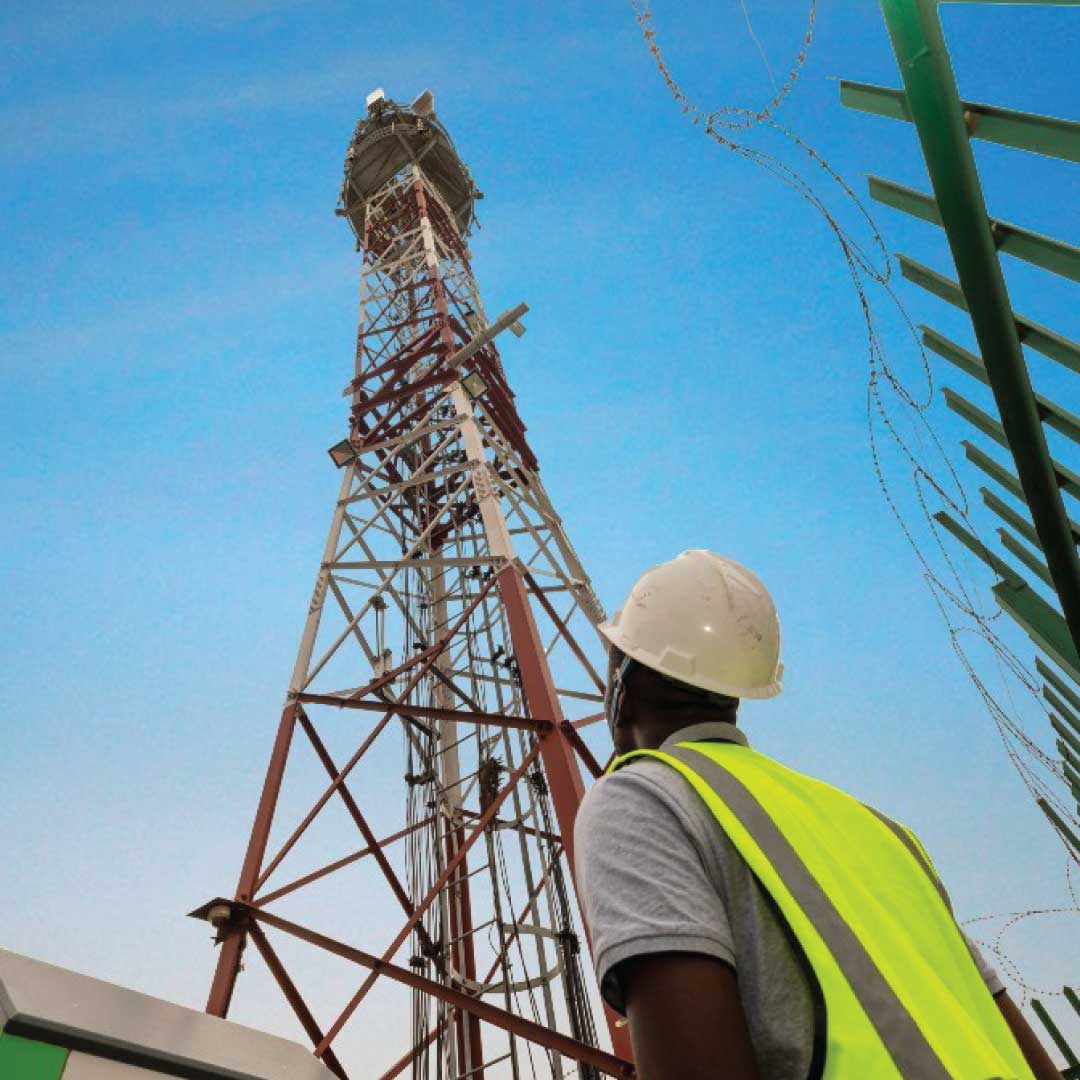

IHS Towers, Africa’s largest independent telecom tower company, has finally posted a profit after three years of heavy losses. In the first quarter of 2025, the company earned $30.7 million, a remarkable turnaround from a $1.5 billion loss during the same period in 2024.

The stronger Nigerian naira and a sharp $1.45 billion drop in finance costs helped IHS move into profitability. Since 58 percent of its business is in Nigeria, the country’s currency fluctuations have a big impact on the company’s results.

IHS recorded 5.2% increase in revenue to $439.6 million

IHS recorded a 5.2 percent increase in organic revenue to $439.6 million, despite persistent macroeconomic headwinds from currency volatility.

Resets of foreign exchange, power indexation, ongoing tenant expansion, lease amendments, and new site activations were all cited as reasons for this growth.

“This has been a strong start to 2025 with solid growth across our key metrics of revenue, adjusted EBITDA and ALFCF,” said Sam Darwish, IHS Towers Chairman and CEO.

He added that the strong performance “is a continuation of the trends we have seen in recent quarters as we benefit from the commercial and financial progress that was made during 2024 and into 2025.”

IHS’s return to profitability yet to off-set previous losses

IHS Towers has gradually returned to profitability. The company reduced its losses from $1.98 billion in 2023 to $1.64 billion for the full year 2024.

Despite a turnaround from a loss during the same period last year, the fourth-quarter profit was insufficient to make up for the full-year losses, which were mostly caused by unrealised foreign exchange losses.

Nigeria’s improving situation, which includes recent tariff hikes and increased naira stability, is boosting confidence. A major factor in IHS’s improved fortunes and its ongoing push for the rollout of 5G in its markets is the improved performance of its major clients, such as Airtel and MTN Nigeria, both of which have returned to profitability.

The company’s stock price has recovered remarkably, currently trading at $6.25 (down a modest 0.080 percent from yesterday), after hovering around $2 for the majority of 2024. By selling off non-core assets, IHS is also aggressively pursuing shareholder value. It has recently sold its operations in Kuwait and Peru and is currently considering selling its operations in Rwanda.