I remember following my mum to the old Cooperative bank. The inefficiencies associated with manual operations meant that banking halls were always full, and you could spend an entire day standing on the queue.

However, one thing that remained constant in those days was that your money is relatively safe. We were satisfied with our banking services at the time.

Today, the introduction of technology into the Nigerian banking sector remains a highly controversial topic. It is puzzling how processes and services that run smoothly in other climes often become ineffective here. Despite banks declaring huge profits annually, their digital platforms continue to frustrate customers, while regulators seem to turn a blind eye.

One major issue is the poor quality of service (QoS) on various online platforms and banking apps. For instance, Polaris Bank’s digital platforms have reportedly been down for at least three weeks.

Users frequently encounter difficulties completing transactions, receiving instant alerts, or even logging into their accounts. These problems tend to worsen during critical periods, such as month-end or peak hours, causing immense frustration and sometimes even monetary losses.

Another significant problem is the slow response time when transactions fail. Checks on the GTBank website sometimes shows a timeout error.

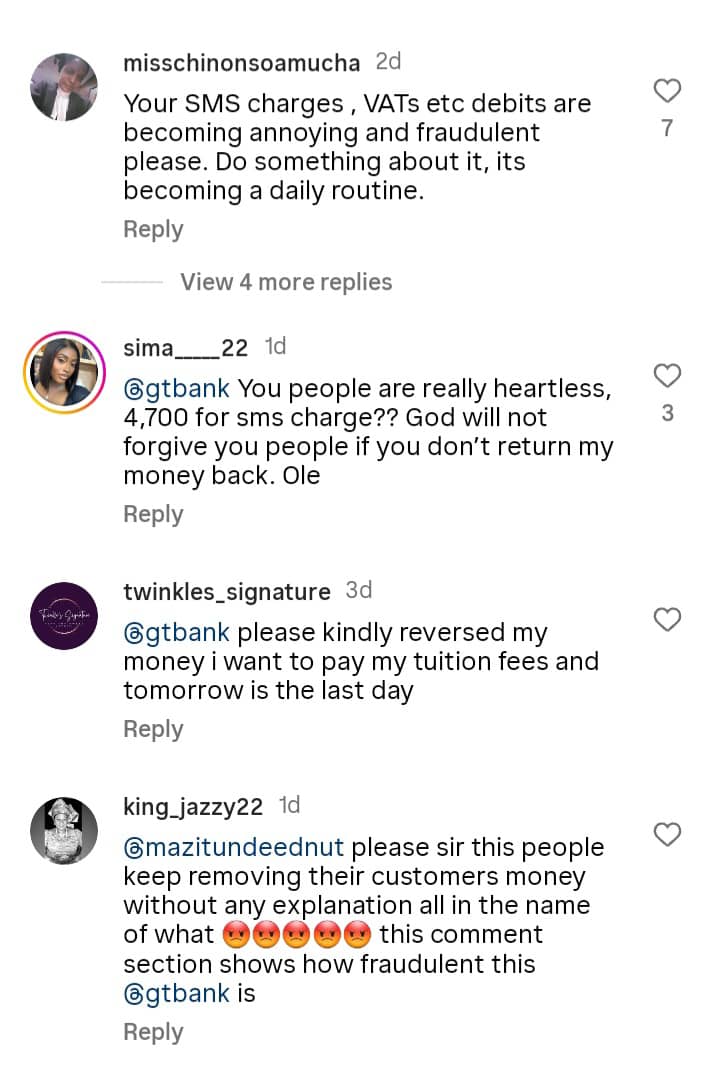

Although GTBank disabled replies on its official X account, the comment section of its Instagram post is littered with customer complaints that the bank failed to attend to.

Many Nigerians have experienced unsuccessful transfers where funds are deducted from their accounts but never credited to the recipients. Given the urgency often attached to financial transactions, resolving such issues can take days or even weeks.

For the ATMs, the less said, the better. There are also operational issues that ATMs nationwide face. It is not unusual to come across machines that are either out of order, unable to distribute cash, or even debit clients without providing them with any payment. Significant lines form at the few automated teller machines (ATMs) that are operational in many regions, particularly on weekends and holidays.

Expectations were high that the introduction of technology would enhance the quality of service through mobile banking applications, online banking, USSD codes, and automated teller machines (ATMs). Despite this, a significant number of customers continue to experience subpar technology services, which undermines the accomplishments that the sector claims to have accomplished.

Inadequate technology services will continue to be a barrier to the expansion and reputation of Nigeria’s banking sector unless considerable changes are made. In my opinion, technology that has brought more problem than solution to the Nigerian banking sector.