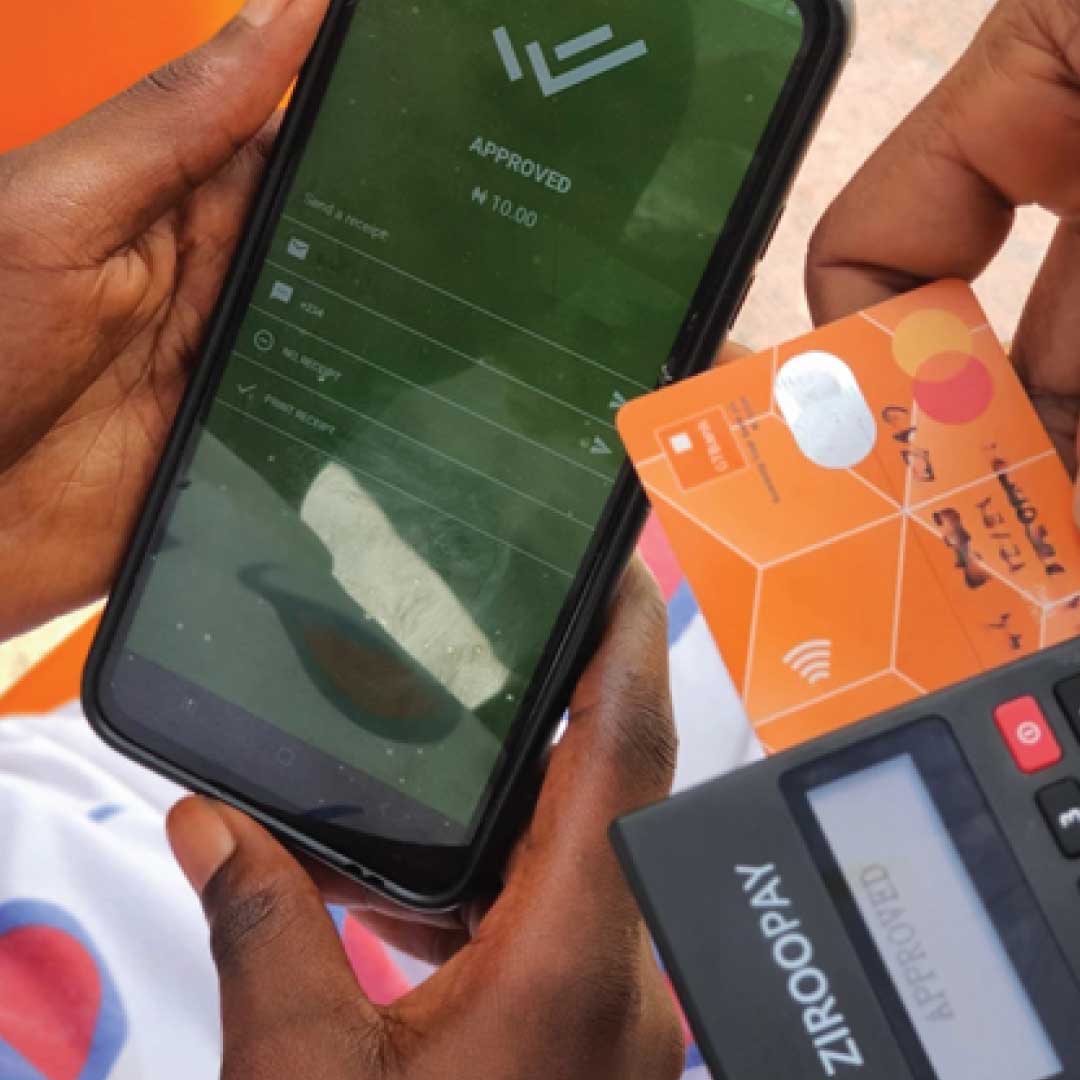

Zambian neobank Lupiya has announced a new partnership with Network International, a leading enabler of digital commerce across Africa and the Middle East, to launch an e-commerce-enabled debit card.

This initiative marks a significant step towards expanding financial inclusion across the continent by providing individuals and small businesses with more secure and accessible financial tools.

Read also: Zambian fintech Lupiya wins GITEX Africa supernova challenge

Expanding MEA’s Financial Inclusion Through Digital Innovation

Lupiya, which operates in Zambia and Tanzania, has established itself as an AI-driven neobank that provides financial access to underserved populations. The platform uses alternative data and machine learning models to assess creditworthiness, enabling individuals and businesses traditionally excluded by banks to access loans and secure payment services. Lupiya’s existing services include personal loans, SME financing, and digital payments.

With the introduction of the new debit card, Lupiya plans to diversify its offerings beyond lending by providing seamless and secure digital payment options. The card will feature 3D Secure and tokenisation, ensuring enhanced security for online transactions. This will allow users to engage in e-commerce, knowing their payments are protected confidently.

Network International’s Role in the Partnership

Network International, which supports over 250 financial institutions and 130,000 merchants across 50 countries, brings its extensive expertise in digital commerce to this partnership. The company is known for enabling secure and efficient payment solutions across the continent, making it an ideal partner for Lupiya’s expansion.

The collaboration will enable Lupiya to offer its customers a broader range of financial services, from simplified lending to secure, real-time payments. By tapping into Network International’s infrastructure, Lupiya can scale its services and improve the overall financial inclusion landscape in Zambia, Tanzania, and beyond.

Read also: Sabipay, Pesapal’s Zambian arm, gets an e-payments license from the Bank of Zambia

Empowering Individuals and Small Businesses

Lupiya CEO Muchu Kaingu expressed excitement about the new development:

“At Lupiya, we are driven by the mission to revolutionise financial inclusion across Africa. Our partnership with Network International represents a significant leap forward in providing secure, accessible, and innovative digital financial solutions,” Kaingu said.

“Launching an e-commerce-enabled debit card with 3D Secure and tokenisation empowers individuals and businesses to participate in the digital economy more effectively.”

This new product aligns with Lupiya’s vision of economic empowerment and its commitment to using AI-driven solutions to foster financial independence. Lupiya aims to provide new and existing customers easy access to essential financial services by linking customers directly to the formal financial system.

Lupiya’s launch of the e-commerce-enabled debit card in partnership with Network International is a significant milestone in its mission to promote financial inclusion across Africa. The new card will empower users with secure and convenient digital payment options, further enhancing Lupiya’s value proposition in the African fintech space.