In a groundbreaking partnership, M-PESA Africa has joined forces with Remitly and Vodacom Lesotho to launch a pioneering service that enables individuals in 30 countries to send money directly to M-PESA accounts held by Vodacom Lesotho subscribers.

This innovative solution will provide millions of people with a fast, convenient, and secure way to transfer funds across borders, bridging the gap between loved ones and businesses alike.

This new service, carried out by M-PESA Africa, Vodacom Lesotho, and Remitly, provides quite an innovation in the category of global money transfers. The service aims to make it far easier to send money overseas by using M-PESA’s existing mobile money platform, Vodacom Lesotho’s broad reach, and Remitly’s digital remittance know-how.

Read also: Safaricom Ethiopia partners Woda Metals to expand telecom tower Infrastructure

The service will significantly benefit the thousands of Basotho in the Diaspora who transfer money to their home-based relatives. With this introduction, money will be remitted to Lesotho phone numbers securely and instantly, bypassing the traditional banking network’s need, minimising the time spent per transaction, and easing costs.

Promoting Financial Inclusion

One of the core objectives of this work is to stimulate financial inclusion. A large proportion of the population of Lesotho, particularly people who are living in rural areas, have little access to formal financial services. The fact that they receive international remittances directly into M-PESA accounts provides a welcome financial lift that enables the recipients to access the monies quickly and when they find fit.

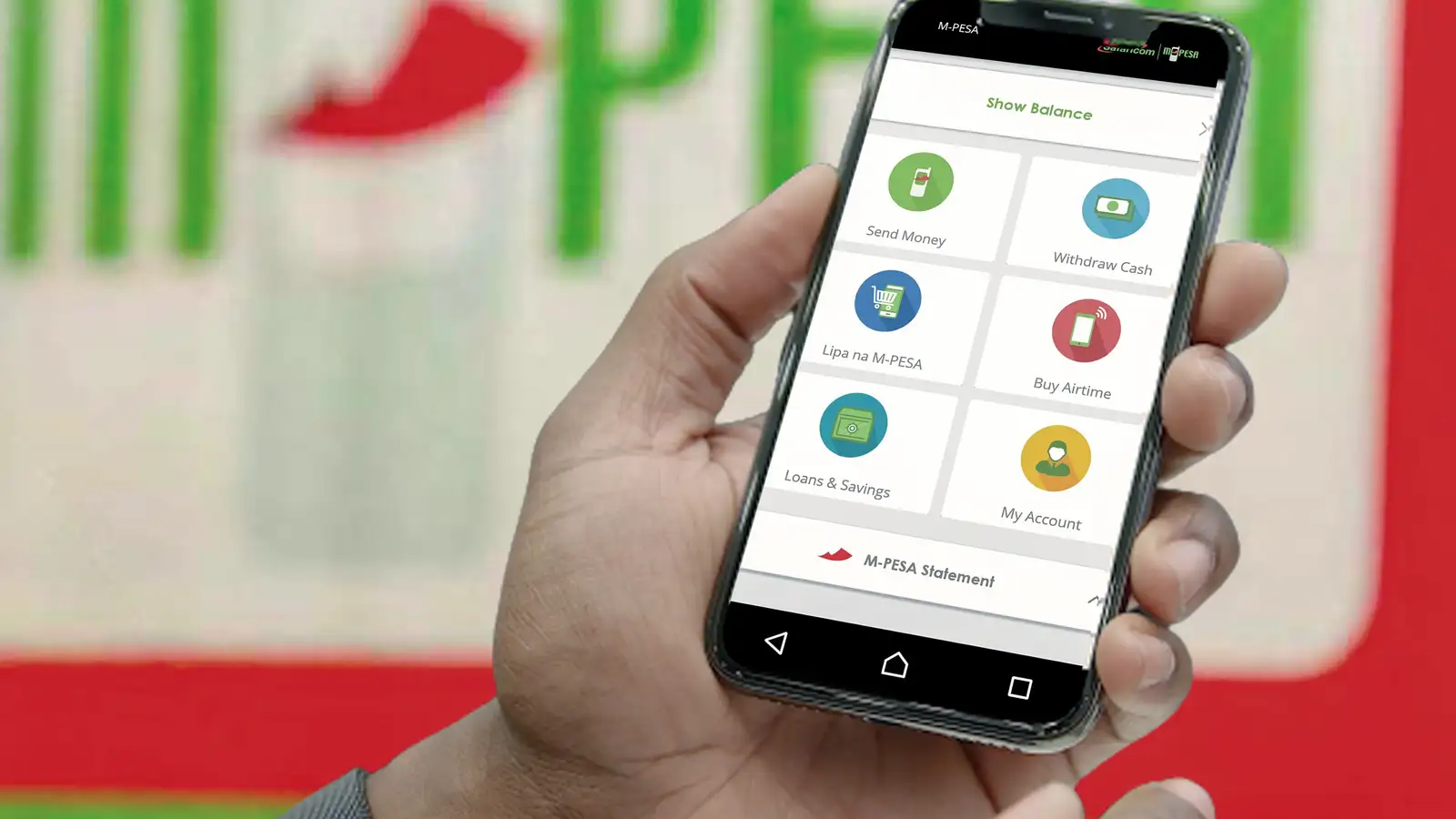

As an African pioneer in mobile money services, M-PESA provides various other financial services like savings, loans, and bill payments. Its international remittance inclusion platform will put M-PESA in a very competitive position, and the platform will be able to provide its customers with a whole bouquet of financial services.

Remitly, one of the world’s most prominent digital remittance outlets, is a critical player in this project. The digital platform is famous for its ease of use and favourable exchange rates. Remitly facilitates fund transfers from more than 30 countries, including the United States, the United Kingdom, Canada, and Australia. The collaboration is crucial in ensuring that senders have an effective and timely solution when transferring funds to their family members in the kingdom of Lesotho.

The possibility of Remitly being compatible with M-PESA accounts ensures safe and fast money remittance. The easy compatibility improves users’ experience and thus makes it possible for people to support their families and meet their financial needs quickly.

Socio-Economic Benefits

The new service is also expected to have a considerable economic and social impact in Lesotho. Remittances form a crucial income source for many people’s households, enabling many to finance day-to-day living use for education, health care, and other needs. By enabling the receipt of remittances more quickly and conveniently, the service will enhance the financial security of many families.

Read also: Safaricom Ethiopia’s $1.5 billion investment with local telecom tower yields results

Moreover, with the increased influx of remittances within Lesotho, domestic demand can spur economic activity and business. When the people who receive the remittances spend money on goods and services, demand and opportunities for local entrepreneurs and vendors are generated.

This partnership of M-PESA Africa, Vodacom Lesotho, and Remitly displays a futuristic partnership within the digital financial services industry. It comes in the wake of continued calls to use technology to improve financial inclusion and economic growth in Africa. Through affordable and effective financial services, this partnership stands to be a bridge towards innovation in the fintech space.

The partners are committed to continually tweaking and improving the service, looking for new methods of serving their customers’ needs, which are constantly changing, including more features on the platform, new features, and growth into new markets.