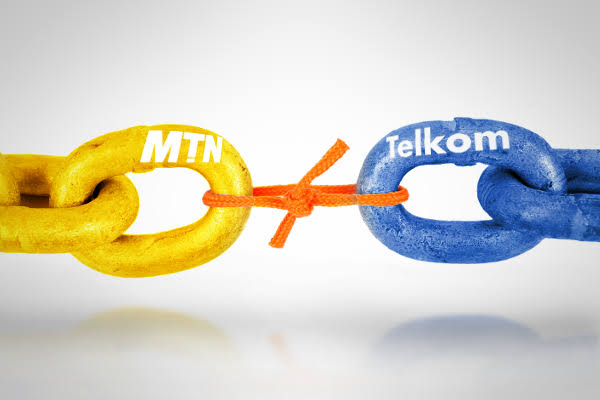

Africa’s largest mobile operator, MTN, has called off its merger and acquisition proposal with South Africa’s third largest mobile operator, Telkom. MTN claims it’s cancelling the acquisition proposal due to a lack of exclusivity.

In a statement published in South Africa on Wednesday, Telkom SA confirmed that MTN had closed discussions over a possible acquisition.

On Wednesday, Telkom explained in a statement that “discussions were at an early stage and had not progressed due to due diligence nor had a binding offer been received by the Telkom board of directors. The Telkom board has a legal and fiduciary duty to consider all bona fide offers”.

MTN said in a statement that after “extensive engagements and deliberations between the parties, shareholders are advised that the discussions regarding the proposed transaction have terminated, as the parties were unable to reach an agreement to their mutual satisfaction on the process going forward.”

MTN added, “Consequently, caution is no longer required to be exercised by shareholders when dealing in MTN securities.”

Read also: Government acquires Telkom Kenya entirely

What Happened After The Merger Break

Shares of South Africa’s third-largest mobile operator, Telkom, crashed almost a quarter on Wednesday after it announced that Africa’s largest mobile operator, MTN, had called off takeover talks.

As of Tuesday’s close, Telkom’s shares had gained more than a third since MTN had announced the discussions about a potential acquisition in July, but On Wednesday, Telkom had crashed 22.61% to R34.64, while at the same time, MTN had backslid at 2.27% to R125.90.

The news was not well received by shareholders, with Telkom’s share price on the Johannesburg Stock Exchange dropping.

“MTN terminated discussions in relation to the MTN proposal on October 18, as Telkom was not in a position to provide MTN with assurances around exclusivity,” partially state-owned Telkom said in a statement.

It was reported that the SA government had received an unsolicited R7 billion bid for its 40.5% stake in Telkom from investment firm Toto Consortium, part of a consortium that controls a 24% stake in Richards Bay Minerals, majority owned by mining giant Rio Tinto.

Telkom had net debt of R7.5 billion at the end of March, and its board is currently considering ways to unlock value for shareholders, believing that the price at which its shares trade does not reflect the underlying value of the business.

PEACE Partners with Telkom to successfully Land Submarine Cable in Kenya

Telkom Other Interested Party

MTN had announced the discussions about a potential acquisition in July, while Telkom had also received a proposal from data-focused mobile operator Rain.

Rain’s public expression of interest in a merger in August had resulted in a public reprimand from SA’s takeover regulator, given that it hadn’t given any approvals. It also came shortly after MTN said it was considering buying Telkom in return for shares or a combination of cash and shares. Rain then made a formal proposal on 14 September.

In an announcement, Rain said it made a formal request to present the Telkom board with a proposal that would ultimately result in the merger of the two companies.

Brandon Leigh, CEO of Rain, believes that if the two companies merge, they will create a cost-efficient operation that would turn Telkom’s cash-flow situation around. Telkom generated a negative free cash flow of R2.1 billion in 2021.

Leigh said Rain has little debt and sufficient facilities to fund its growth.

“As a standalone company, Rain has adequate funding for its rollout and growth, and we assume Telkom has the same. However, significant savings in capex [capital expenditure] and opex [operating expenses] from the combined network will be cash generative,” he said.

One of Rain’s major shareholders, African Rainbow Capital, values it at about R18 billion, while Telkom was valued at R22.88 billion on Tuesday’s close, and MTN was worth R242.8 billion.

Rains says the merger will create a “5G powerhouse”, a strong third player to compete against a “telecommunication duopoly” in South Africa and also mooted other benefits, including in terms of infrastructure.

According to Rain’s words “In 5G, the opportunity would exist to leverage the fibre network of [Telkom’s fibre network company] Openserve and Rain’s 5G expertise to accelerate the rollout of 5G nationwide and further grow homes passed. 5G to the home is a very attractive alternative to ADSL, 4G and fibre, and can provide Telkom and Openserve’s existing home customers with a plug and play solution as well as attracting new customers as the home broadband market continues to grow.”

Rain also wants to enter the mobile market. Telkom already has more than 17 million active mobile subscribers.

“In combining their resources, a merged entity would be able to build on Telkom Mobile’s success in 4G and, in future, in 5G, which is expected to feed consumer demand for faster connectivity driven by streaming, gaming and virtual reality.

“The merger is a logical alternative to simply selling to MTN and would also be consistent with the pro-competitive policies of the government,” said Rain. The government owns 40% of Telkom.