Network International, a top digital payments provider in the Middle East and Africa, has joined forces with Ghanaian fintech Blu Penguin to enable mobile money transactions on N-Genius™ point-of-sale (POS) terminals.

The partnership is already being rolled out across Ghana and aims to simplify payments for merchants while advancing financial inclusion across the region.

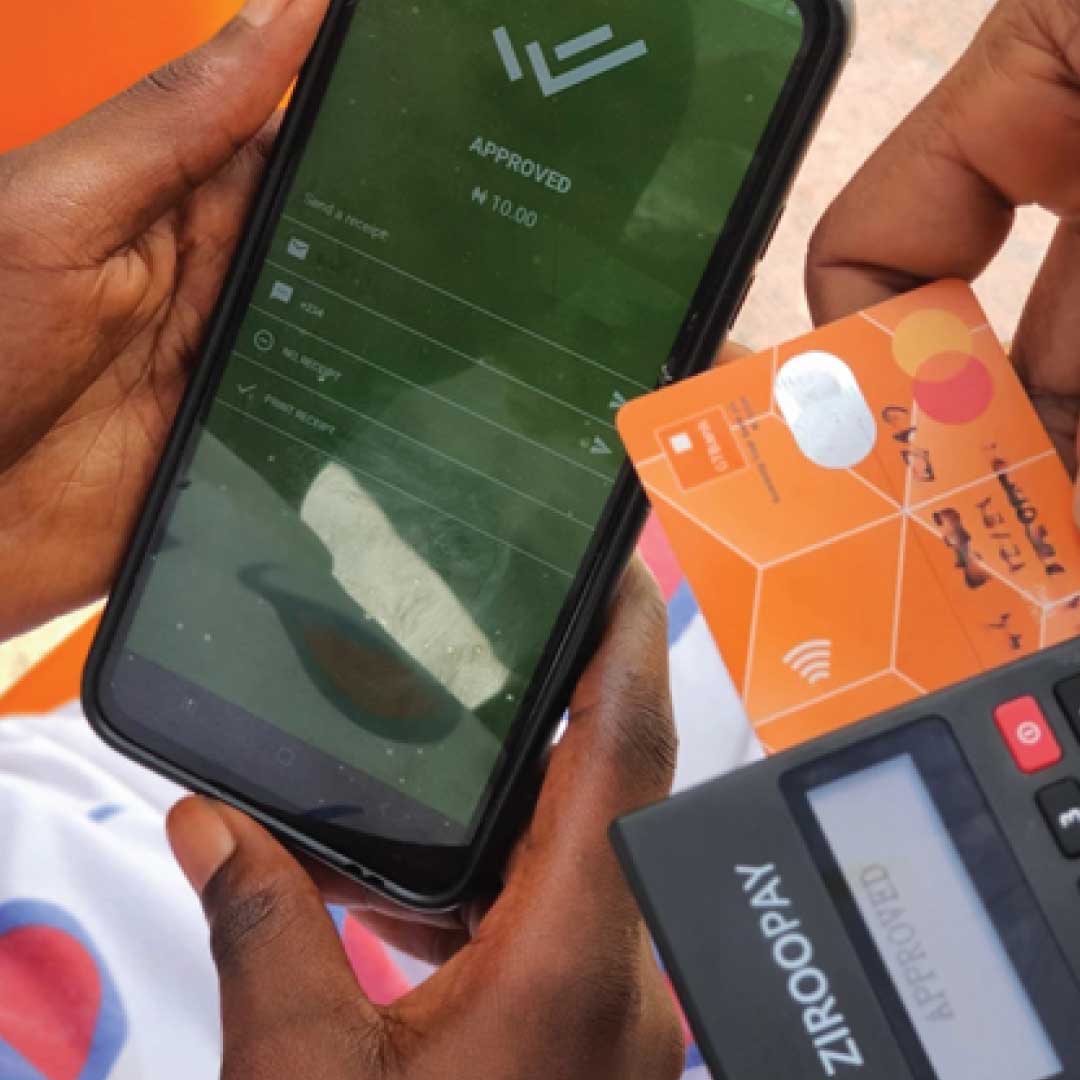

By integrating Blu Penguin’s mobile money technology into Network’s POS infrastructure, the collaboration allows businesses using N-Genius devices to accept payments from all major mobile money providers.

This is a big win for Ghana’s retail and banking ecosystem, which has seen growing demand for flexible, cashless transaction options that serve both banked and unbanked populations.

Expanding digital payments across Ghana and West Africa

The new service is expected to transform how merchants, banks, and customers transact by offering multiple payment options within a single, unified app.

It enhances the utility of N-Genius terminals beyond card payments, streamlining mobile money acceptance without the need for additional devices or integrations.

“By integrating mobile money transaction capabilities into our N-Genius terminals, we are providing a seamless payment experience that caters to the needs of both banked and unbanked individuals, helping businesses and financial institutions offer greater transaction flexibility,” said Chinwe Uzoho, Regional Managing Director for Western Africa – Processing at Network International.

Blu Penguin’s mobile-first approach has already gained traction in Ghana, Côte d’Ivoire, and the Democratic Republic of Congo.

The company’s backend will integrate seamlessly with Network’s acquiring infrastructure, ensuring secure and efficient mobile money processing across major telecom providers in the region.

Sebastian Yalley, Managing Director for Ghana Processing at Network International, described the initiative as a major step forward for Ghana’s payment landscape.

“It enhances our service offerings for banks by combining Blu Penguin’s strong mobile money processing capabilities with our industry-leading card infrastructure.”

Driving financial inclusion through tech collaboration

The collaboration goes beyond simply adding mobile money to POS terminals—it’s a strategic step toward transforming the digital payments space in Sub-Saharan Africa.

For banks and merchants, it means easier onboarding and fewer technical hurdles. For consumers, especially in underserved communities, it means more ways to pay and get paid.

“This collaboration goes beyond technology integration; it is a strategic effort to improve payment accessibility and convenience for merchants in Africa,” said Tenu Awoonor, Founder of Blu Penguin. “By partnering with Network International, we are equipping banks and merchants with the ability to offer multiple payment options in a single app, making transactions more seamless.”

The rollout has already started in Ghana, with plans to scale the solution to other Sub-Saharan African markets using Network’s infrastructure.

The long-term goal is to enable seamless mobile money acceptance across the continent—helping merchants meet customer demands while bringing more people into the digital economy.

As fintech adoption accelerates across Africa, this partnership sets a strong example of how regional collaboration and innovation can push the boundaries of financial inclusion and modernise the payment experience.