Kuda Bank, Moniepoint, OPay, and Palmpay have temporarily halted new customer account openings following a directive from the Central Bank of Nigeria (CBN). On Wednesday, the Economic and Financial Crimes Commission (EFCC) blocked 1,146 bank accounts involved in unauthorized forex dealings.

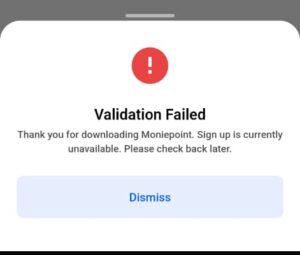

In response to the directive, notices across these popular fintech sites display prompts indicating that they have temporarily paused new signups on their platforms. We apologise for any inconvenience this may cause.

Techpression also confirmed the pause in the new account opening on all four apps, as every attempt to sign up was unsuccessful.

Read also: CBN bans fintechs from international payments services

Existing customer’s transactions remain safe

While the pause in new signups is a significant development, it’s crucial to note that existing customers can continue their banking activities without disruption. This pause is a result of increased scrutiny over fintechs’ account opening processes, with Fidelity Bank previously blocking transfers to OPay, Palmpay, Kuda, and Moniepoint due to KYC processes leading to heightened fraud cases. The Central Bank has introduced new KYC rules for all financial institutions, particularly impacting fintech startups.

The recent directive to pause account openings is part of an ongoing audit of the KYC processes of these fintechs, according to an executive at an affected fintech, who described the pause as temporary. The Central Bank and the National Security Agency (NSA) engaged in discussions with representatives of the affected fintechs on April 26, focusing on concerns related to crypto traders leveraging fintech platforms to disrupt the FX market. This is the primary reason behind the pause in new signups.

While the EFCC’s investigation into unauthorized FX dealings involves many commercial bank accounts, only 10% of the 1,146 blocked accounts are associated with fintechs. The NSA denied any connection to the directive to halt new account openings, emphasising the need for fintechs to build stronger relationships with regulators.

Read also: Mobile money, digital lending to lead Nigeria’s service sector

The Central Bank’s actions come amid concerns of naira manipulation by speculators, which led to record lows in 2024. The crackdown on Binance, a global cryptocurrency exchange, was initiated after claims that significant funds passed through the platform from unidentified sources. This crackdown resulted in tax evasion and money laundering charges against two Binance executives, along with restrictions on peer-to-peer trading.

In a related move, the CBN mandated all financial institutions to collect ID cards before creating financial accounts, contradicting a previous rule supporting financial inclusion that allowed Nigerians to open accounts without identity cards. The Nigeria Inter-Bank Settlement System (NIBSS) also instructed banks and mobile money operators to delist unlicensed fintechs from directly accepting consumer deposits, reflecting a broader regulatory shift in the Nigerian financial landscape.