What is PayPal?

PayPal is an online payment system that enables users to send money to friends and family, pay for transactions, and accept payments when selling goods or services. To protect your funds and details, PayPal has set up security precautions like encryption and purchase protection.

In 2015, PayPal, a former eBay subsidiary, was separated into a new business. In addition to accepting payments online, PayPal also provides credit card readers for use in companies, a debit card for payments, and lines of credit.

Once your bank account, credit card, or debit card is linked to your PayPal account, you can use PayPal to make purchases from stores online. Since PayPal serves as an intermediary between your bank and merchants, your credit card information is secure with them.

PayPal allows you to send and receive money safely from others as well as to transfer money to friends and family. This option is helpful for situations like dividing costs with pals or receiving money from family.

Read also: How To Enable Bitcoin On Cash App: A Complete Guide In 2022

Why do people use PayPal?

PayPal is a widely used online payment system. It is very simple to use, and many people use it for the following reasons:

Cost

The cost is one of the key factors influencing individuals to use PayPal instead of alternative payment methods. It has no yearly membership costs and is free to use. PayPal allows users to make payments for their online purchases without paying any fees to the merchant.

User Discount

In addition to being free to use, the site gives its customers discounts at particular stores when they pay with PayPal. When using PayPal to make a purchase, all a user needs to do to take advantage of the discounts is copy the promo code from the PayPal shopping page and paste it on the retailer’s website.

Utilization of Mobile Devices

PayPal is simple to use because users don’t need to be online to utilize the system, and the iPhone application makes it simple to send and receive money online. The software is secure because it requires the user to input their own PIN; alternatively, you may bump phones with the person you need to send money to while they are out and about.

Various Methods of Payment

When using Paypal, a user can enter numerous credit cards or bank accounts, and money will be withdrawn in the specified sequence from each source. Since the transaction will always be successful the first time, the user may relax knowing that there will be no problem.

Security

Because it is a secure method of online shopping, PayPal is frequently used by customers while they are checking out on a website. There is no need for a customer to exchange financial information with the business to make a transaction. Industry-leading fraud prevention systems safeguard the financial information of PayPal’s customers. PayPal takes security very seriously. After entering their credit card and bank account information just once, users are free to stop disclosing further personal data online.

There are numerous other online payment methods, but it seems like they have a long way to go before they can match PayPal’s level of popularity.

Steps to create your Paypal account

It costs nothing to open a PayPal account. PayPal doesn’t charge any fees for transactions when you buy things or send money to other people. You can send money or make online purchases using PayPal if you have funds in your account. Credit and debit cards both have transaction fees. Additional costs will be applied if money is received or transferred from outside the US.

A PayPal account can be created with only a few things. This includes a credit or debit card that is currently in use, recent bank records for confirmation, and a photo ID like a passport or another government-issued identification card.

Follow the steps listed below to set up your PayPal account:

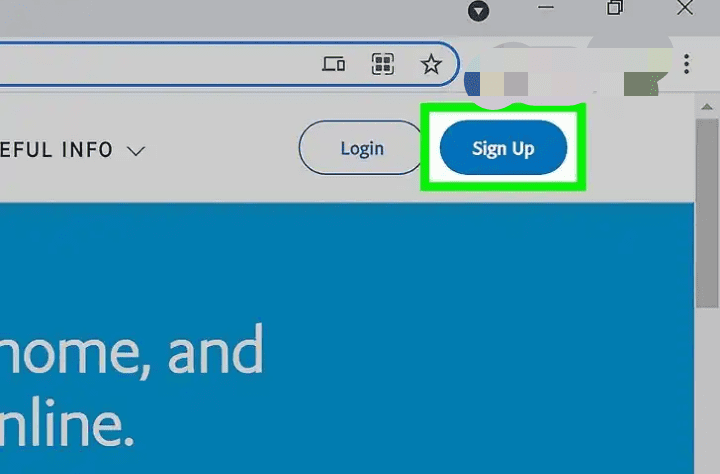

- Open the PayPal website and select “Sign Up” from the menu in the top right corner of the screen.

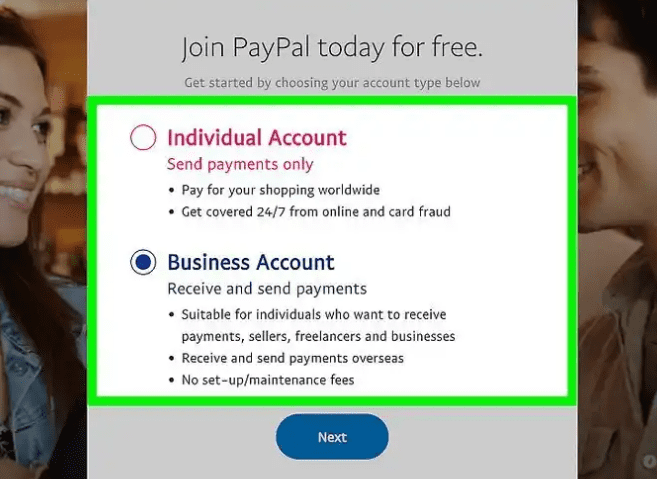

- Select either a personal or business account, then click Continue.

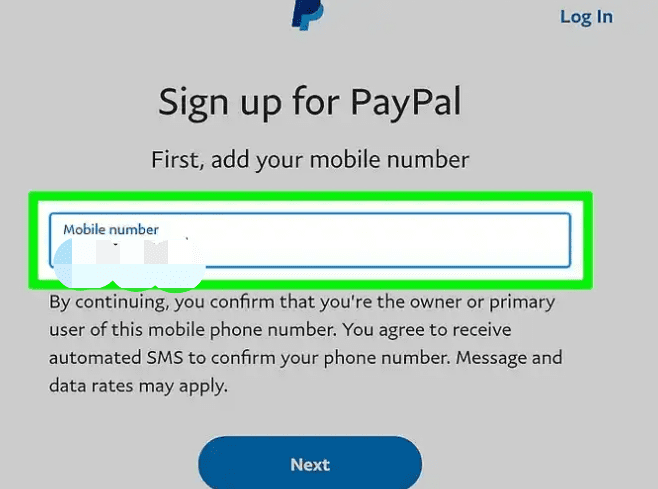

- Your mobile number must be entered on the page before a verification procedure can begin.

- Your personal information will need to be entered after your phone number has been validated. This contains your name, email address, and account password. Click Continue to continue with the application after that.

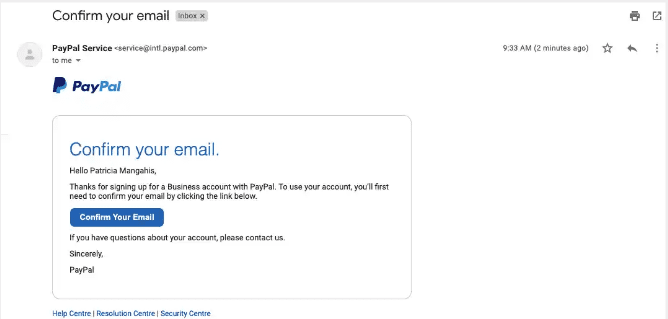

- A link will be sent to your email address; make sure you click it to verify your email address.

- The next step is to input your current address and other relevant data. Click Continue after you’ve entered.

Optional Step: Click the Get Started button and then enter your bank information, including your card information and financial information. To accept the terms of use, read the terms and conditions and check the box. Your PayPal account is now available for use.

The two types of PayPal accounts (Personal and Business) meet the needs and interests of the vast majority of people.’

How to withdraw from your Paypal account

- PayPal makes it as easy as possible to withdraw money from your PayPal wallet to your bank account by following a few simple steps.

2. Go to the PayPal website using your browser. When the website first loads, the upper-right corner of your screen will have a Login option. Click it to go to the log-in page.

3. Enter your PayPal account ID and password in the right places on the login page, then click Log in or press Enter on your keyboard to see your PayPal Account Summary.

4. On the account summary page, your balance will be shown in big, bold numbers at the top left, along with a ton of other information and options about PayPal. To get your money, click the “Transfer Money” button right next to the amount of your balance on the screen.

5. You will be taken to a new page where you can add money to your PayPal account or withdraw money from PayPal to your bank account. Click on “Transfer From PayPal To Your Bank Account” because you want to withdraw right away.

6. You will have two options on the following screen: Instant and Standard.

Instant: Select this choice if you want your money as soon as possible. However, 1% of the amount that is transferred to your bank account will be debited to you.

Standard: If you don’t need your PayPal balance to be moved immediately, you can select the standard option to have all of it, or just a portion of it, sent to your bank account. When the money is available, it will appear in your account.

7. If your PayPal account has more than one account attached to it, you can choose the button next to the account you wish to transfer money to and then click Next.

8. You will now be taken to a screen where you can type the amount you want to transfer. You don’t need to subtract the 1% fee manually, and you don’t need to type any decimals or commas.

9. PayPal will take care of everything. After making sure everything is in order, click Next to proceed.

10. If you select instant, PayPal will break down your funds on the following page and provide the exact amount of the 1% fee. Sim, confirm if everything is in order.

11. PayPal sends you a confirmation message as your request is processed in the final phase.

Read also: Paypal enables passkey payments

How to Get a Free Verified PayPal Account in Nigeria

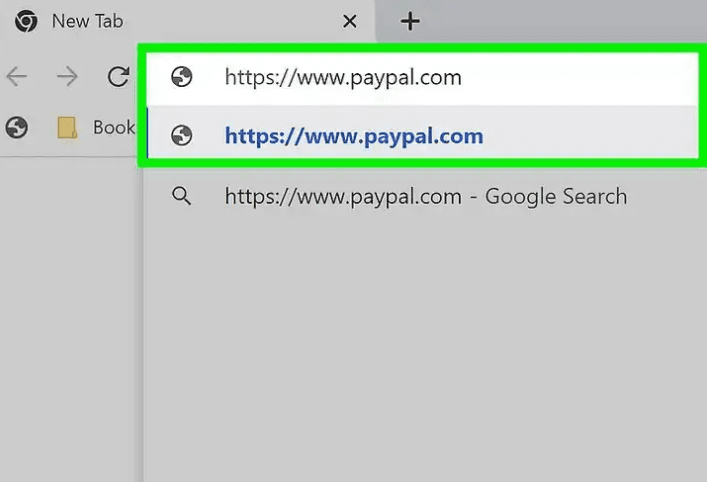

- Use the Google Chrome browser to visit the PayPal website.

- Choose to open a PayPal account.

- Enter your accurate personal information.

- Use your email to confirm your PayPal account.

- Sign in to your new PayPal account.

- Verify your additional information and begin using PayPal.