Africa has often been at the forefront of embracing and adapting to new technologies, and today, the continent is witnessing a surge in grassroots crypto adoption. Much like the transformative role played by mobile money platform M-Pesa in Kenya, Africans are harnessing the potential of crypto and Web3 technologies to challenge traditional financial systems.

Read also: Vella Finance to discontinue crypto trading and focus on SME banking

Africa’s Crypto Adoption Growth

The Global Crypto Adoption Index highlights Africa’s substantial growth in grassroots crypto adoption. African countries are progressively becoming hotspots for crypto and Web3 innovations, driven by the increasing adoption of digital payments.

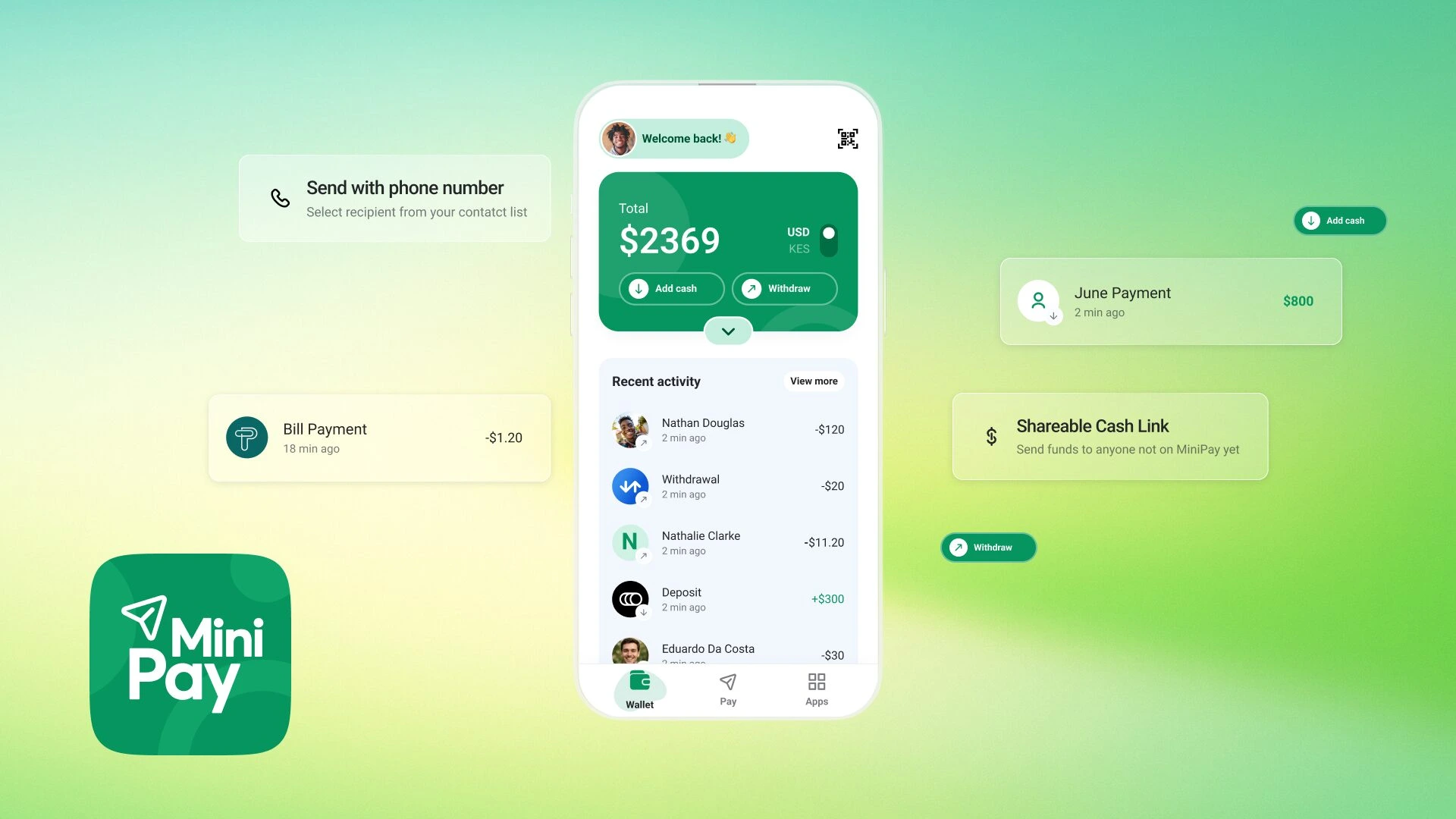

In line with this trend, the web platform Opera has introduced a non-custodial stablecoin wallet integrated into its mobile web browser, catering to its extensive user base across the African continent. Opera conducted a survey of more than 5,000 Opera Mini users, with over 90% expressing a strong interest in having a digital wallet seamlessly integrated into their browser.

The Influence of M-Pesa

M-Pesa, initially launched in 2007 by Vodafone and Safaricom in Kenya, was a pioneering platform that aimed to serve “the unbanked” population. This innovation significantly reduced poverty levels in Kenya, extending financial access to previously marginalized individuals.

Over time, M-Pesa’s influence has grown, with over 98% of Kenyans using some form of mobile money. Ghana, Nigeria, and South Africa are also experiencing significant increases in digital payments, with adoption rates of 96%, 66%, and 43%, respectively.

MiniPay in Nigeria

Understanding the high rate of grassroots crypto adoption, openness to new technologies, and Nigeria’s status as a digital payments leader in Africa, Opera recently launched MiniPay in Nigeria. MiniPay has been designed to address specific barriers to accessible payment options, including high transaction fees, the cost of mobile data, and complex navigation.

MiniPay offers users affordable transactions, each costing less than 1 Naira (£.001), and provides flexible fund withdrawals through local payment methods, such as airtime and bank transfers. Funds in MiniPay are stored in cUSD, a stable asset on the Mento Protocol that tracks the value of the US dollar (USD), offering a potential hedge against inflation and local currency devaluation.

The lightweight MiniPay app, only 2MB in size, ensures that users can experience the benefits of Opera’s complimentary data programs without compromising their browsing experience. Transactions can be completed in under five seconds using just a phone number, simplifying the onboarding process.

M-PESA, Microsoft equip African entrepreneurs with digital skills

Web3 and Crypto in Africa

As Africa continues to lead the way in the adoption of transformative technologies, Opera’s integration of MiniPay reflects the region’s growing influence in the crypto and Web3 space. With mobile money and digital payments already embedded in the daily lives of millions of Africans, the transition to crypto and Web3 technologies is a natural evolution, offering new opportunities and challenging the traditional financial system.

In 2023, Africa is emerging as a key player in the world of crypto and Web3, where decentralized finance, NFTs, and blockchain are expected to play a prominent role. Opera’s move to incorporate MiniPay in its browser represents a significant step forward in empowering users across the continent to engage with these innovative technologies seamlessly.

The pioneering spirit that led Africa to embrace M-Pesa is now driving its leadership in the world of Web3 and crypto, setting the stage for a dynamic future of financial inclusion and technological advancement on the continent.

Africa’s diverse cultures, entrepreneurial spirit, and shared history of colonial exploitation are coming together to fuel the adoption of transformative technologies that offer new possibilities for economic empowerment, financial inclusion, and global leadership.

As Web3 and crypto continue to gain momentum in Africa, it is a testament to the continent’s adaptability and resilience. Just as M-Pesa revolutionized financial access and poverty reduction, the rise of Web3 and crypto technologies in Africa promises to reshape traditional financial systems and create new opportunities for individuals and businesses alike. Africa’s journey of technological innovation is far from over, and its impact on the global tech landscape is set to be profound.

As the world looks to Africa for inspiration and leadership in the crypto and Web3 space, Opera’s integration of MiniPay serves as a powerful example of Africa’s dynamic role in shaping the future of finance and technology. In a world where digital innovation continues to transform the way we live and work, Africa’s trailblazing spirit remains at the forefront of change.