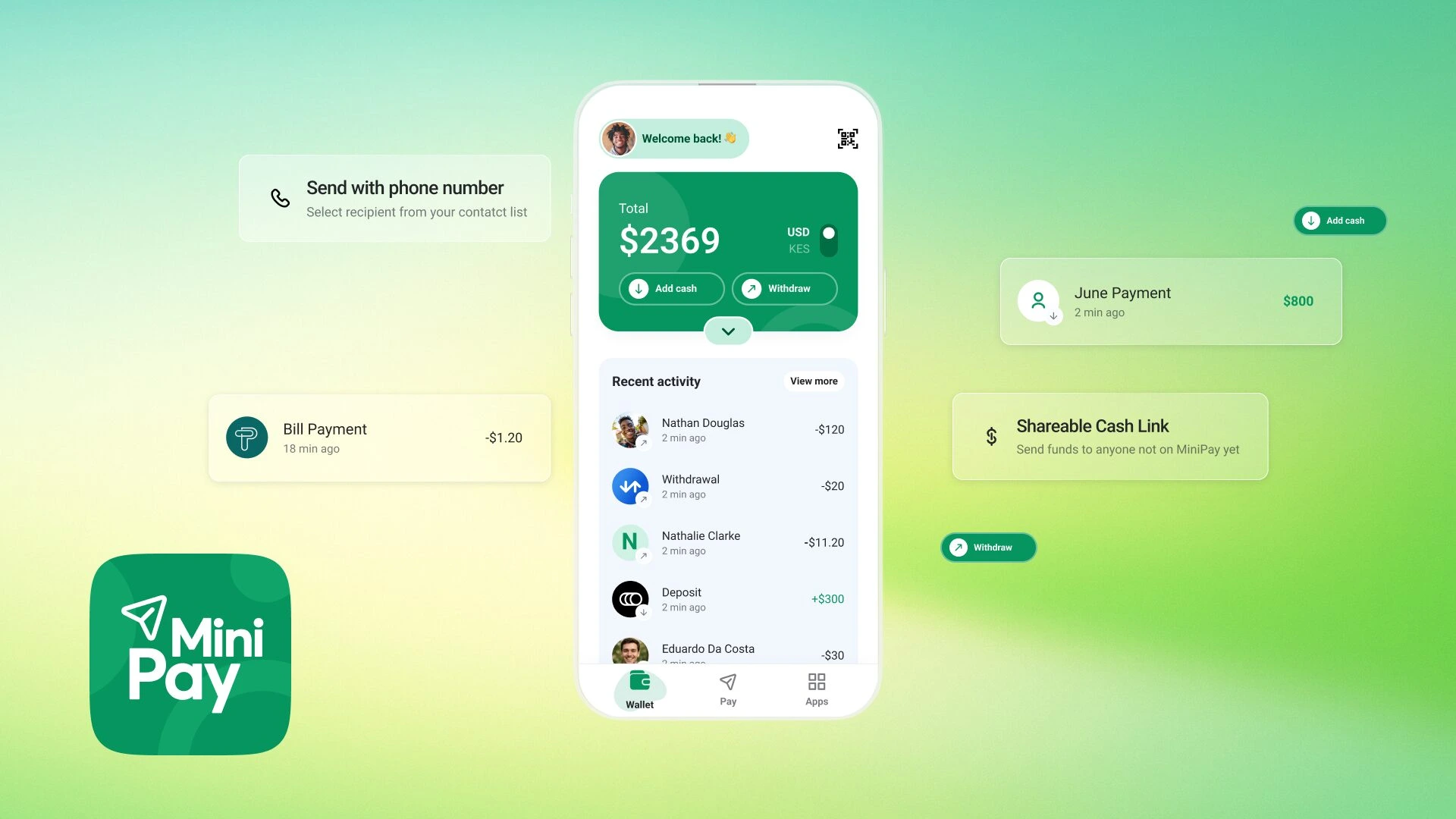

On Wednesday, MiniPay, the award-winning non-custodial stablecoin wallet built on the Celo blockchain, launched a standalone application for iOS and Android devices.

The stablecoin wallet, initially pre-installed in the Opera Mini browser, has now expanded its reach, offering users worldwide a seamless, low-cost platform for instant global payments and financial empowerment.

MiniPay’s expansion continues across various countries.

Since its launch in September 2023, the independent app has gained over 7 million wallets opened across more than 50 countries.

The wallet was designed in partnership with Celo to bridge the gap between traditional finance and Web3 to enable fast and affordable transactions without the complexities of cross-border payments.

“MiniPay represents a new chapter in user experience: a simple, affordable dollar wallet that anyone can use, anywhere. With this launch, we’re removing the barriers that have kept financial systems out of reach for too many people for too long and delivering a real alternative for savings, payments, and cross-border transactions.”

Additionally, it addresses the growing demand for fast, reliable, and low-cost transactions, particularly in regions with volatile local currencies or limited banking infrastructure. The wallet enables users to send dollar-pegged stablecoins like Tether’s USDT globally in under two seconds for less than $0.01.

On the other hand, the integrated Mini Apps ecosystem allows users to pay bills, top up mobile data, purchase eSIMs, shop, and donate—all within the app. Partnerships with services like Ramp, Transak, Binance, and Yellow Card help enable easy conversion between stablecoins and local currencies.

“By removing crypto complexity and delivering real-world functionality through its robust Mini app ecosystem, already opened by more than 5 million users weekly, MiniPay serves as the gateway to the new onchain economy,” said Rene Reinsberg, Celo Co-Founder and Celo Foundation President.

The wallet also caters to modern travelers, functioning as a global wallet for those visiting Africa, Latin America, or Southeast Asia. By loading stablecoins and spending directly through Minipay, users can avoid currency exchange hassles, hidden card fees, and the need for local bank accounts.

“MiniPay is one of the rare cases where blockchain works quietly in the background while users enjoy the simplicity of an app that is as easy to use as any standard mobile service,” added Arnsen.

Global security and financial access

The platform continues to redefine digital finance by merging the security of self-custody with the simplicity of a Web2-style interface. Unlike traditional crypto wallets, it gives users complete control over their assets.

Everything runs smoothly within a single, easy-to-use app powered by Celo’s mobile-first Ethereum Layer-2 network, ensuring fast and affordable transactions built for everyday use.

The network weighs 2MB, mainly for accessibility and low data usage, especially in developing regions. Its integration with popular mobile money platforms like M-Pesa and MTN Momo makes it an ideal solution for unbanked communities.

MiniPay’s standalone launch marks it as a frontrunner in borderless finance.

In Africa, the new launch wallet marks a strategic push into the continent’s fast-growing stablecoin market. As a major investor in OPay, Opera launched the wallet to extend its reach across Africa, where stablecoins have become dominant in crypto transactions, driven by inflation and unstable local currencies.

The app will cater directly to African users ‘ needs with features like M-Pesa and Apple Pay integration in markets like Kenya and South Africa.

With Nigeria alone recording $56 billion in crypto inflows, the app will serve as a user-friendly, mobile-first solution for accessing financial services.

However, its ongoing expansion may be hindered by regulatory challenges, including potential oversight from the Nigerian Securities and Exchange Commission.