PalmPay, a leading Fintech company, has bolstered its in-app safety features to shield users from the surge in fraudulent activities within the digital banking system. The increase in fraudulent incidents has particularly impacted the fintech ecosystem in Nigeria, with Mobile, Web, and Point of Sales (POS) terminals being prime targets for fraudsters in 2023.

The Impact of Digital Payment Platforms on Cyber Fraud

Referencing the 2023 NIBSS Annual Fraud Landscape report, PalmPay highlighted a staggering 325 per cent increase in fraud loss via Internet Banking between 2022 and 2023. This rise in digital payment platforms has amplified the risk of cyber fraud, compelling Fintech companies to navigate a delicate balance between user-friendly interfaces and robust safety measures to combat the escalating cyber threats.

Read also: PalmPay, Glo Unveil “PalmPay Bonanza – Recharge Glo and Win” campaign

PalmPay’s Initiatives to Combat Fraud and Ensure User Safety

In response to the growing fraud epidemic, the Fintech Association of Nigeria (FintechNGR) is set to introduce a fraud reporting framework later this year. Concurrently, Fintech platforms like PalmPay are proactively reassessing their in-app safety features to shield users from fraudulent activities and fortify their defences against cyber threats.

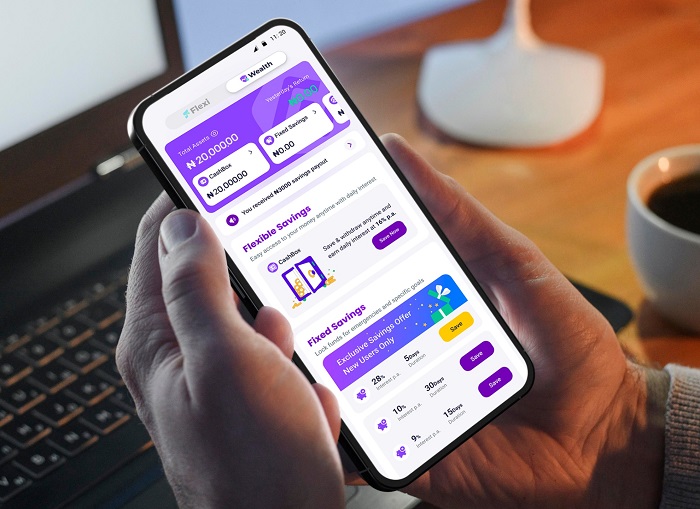

Since its establishment in Nigeria in 2019 under a Mobile Money Operator (MMO) licence by CBN, PalmPay has amassed over 30 million users within its payment ecosystem. The company’s focus on developing a user-friendly app extends beyond convenience to prioritise creating a secure financial environment by integrating advanced safety features into its platform.

Chika Nwosu, Managing Director of PalmPay, emphasised the company’s unwavering commitment to user safety and security as pivotal to its remarkable growth over four years. Nwosu highlighted PalmPay’s approach of harmonising security and safety with customer experience to establish a balanced and trusted environment for users.

Promoting User Education and Compliance

Recognising that combating fraud requires a collaborative effort, PalmPay conducts Wallet Safety Workshops aimed at educating users on various security aspects related to payment security, password management, fraud detection, phishing, and risk identification. These initiatives underscore PalmPay’s dedication to empowering users with knowledge to safeguard their financial transactions effectively.

Incentivizing Compliance with Regulatory Deadlines

To incentivize compliance with the CBN deadline of January 31, 2024, PalmPay introduced a reward system offering up to N500 for users who proactively validated their wallet information ahead of the deadline. This initiative not only encourages timely compliance but also reinforces the importance of adhering to regulatory requirements for enhanced user protection.

PalmPay’s Projections

PalmPay is set to expand its multi-country and cross-border presence in 2024, aiming to grow its user base and deepen financial inclusion. With a remarkable growth from 10 million to 30 million users within 12 months, it has become a significant player in African digital banking.

The platform’s commitment to innovation and bridging the financial divide has led to its success, with over 500,000 agents, 600,000 merchants, and millions of users benefiting from its cashless payment ecosystem. PalmPay’s focus on reliability, security, and accessibility positions it as a trusted platform for diverse financial transactions. As the company plans to launch additional payment channels and super apps in 2024, it continues to drive economic empowerment in Africa through top-tier bill payments, credit services, and savings opportunities for its growing user base.