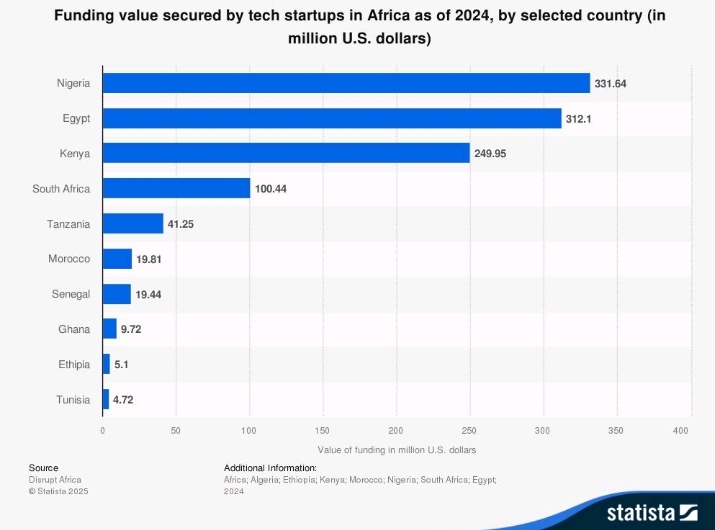

The year 2024 marked a significant downturn in venture capitalist (VC) investment within Africa’s technology sector. With just over $1 billion raised in 2024, according to Disrupt Africa, it’s evident that foreign investment in African tech innovation has significantly diminished.

Tolulope Omoleye-Osindero, a consultant at Accelerate Advisory Limited, highlighted that African innovators are grappling with the challenges caused by this limited inflow of investment.

At the just-concluded UK-Africa Business Outlook on March 26, 2025, experts in technology

project financing gathered to discuss the shifting dynamics of VC investment in Africa. Chris Goodman, Head of Technology Advisory at Standard Bank, pointed out that the changing attitude toward investment is temporary and that an eventual rebound is expected. However, Goodman emphasised that investor expectations are shifting. While growth was previously the primary focus, resilience and the sustainability of businesses have now become equally crucial in the eyes of investors.

A new era of expectations for innovators

This event, organised by Addleshaw Goddard and EventHive, provided the opportunity for technology, investment and financing experts to examine the changing behaviour of venture capitalists in Africa’s tech sector.

As venture capital funding becomes more selective, startups and innovators in Africa must adapt to this new reality. The focus has shifted from rapid growth to demonstrating the long-term sustainability and resilience of businesses. Pierre Deludet, Vice President of Sango Capital, stressed the importance of solving global challenges while addressing local issues. He pointed out that future investor interest will be drawn to solutions that benefit local communities while also having global relevance. African innovators must deepen their offerings to tackle real-world problems, especially in sectors that can enhance the development of small and medium-sized enterprises (SMEs) across the continent.

Gbite Oduneye, Managing Partner at ODBA, echoed this sentiment, stating that the era of easy investment is over. The focus has shifted to businesses that demonstrate robustness and the ability to sustain themselves in challenging conditions. He further explained that funding will continue to be available for ideas that are highly profitable and impactful, especially in sectors that can solve pressing local challenges.

Goodman stressed that technology growth in Africa will remain attractive, but only for real solutions that attend to core issues.

The changing landscape of investment

During a discussion with Dr Pelumi Apantaku, Gbite Oduneye highlighted that venture capital funding is not free money but rather an investment aimed at generating returns.

As a result, African cities with high growth potential will continue to attract investor attention, while rural or remote locations may struggle. However, Goodman noted that investors are gradually turning their focus to innovators in remote areas, especially those who can effectively communicate their stories. In today’s tech-driven world, location should not be a barrier to funding.

Overall, panellists emphasised the increasing need for innovators and start-ups to look inward and raise capital within the continent. Deludet highlighted that Africa needs localised solutions that address its unique challenges. This seeming scarcity of external investment could serve as a catalyst for developing innovative solutions and financing mechanisms that are specifically tailored to address local problems.