A South African fintech company called Revio has taken measures to enable customers access to multiple payment methods and ensure they are done successfully.

Reports say 30% of African payments fail. A fragmented payments landscape, incorrect cards, dormant accounts, and increased dispute rates cause digital firms throughout the continent to lose $14 billion in recurring income annually.

Some projections say digital payments in Africa are growing 20% year, which would exacerbate these issues. While gateways and aggregators make it easy for organisations to accept many payment methods, few solutions exist to aggregate them for requirements and handle platform-specific payment failures.

South African API payment and collections firm Revio have stepped in to help African firms connect to numerous payment channels and manage failures.

Read also: Customers can now make direct deposit payments on Stitch

In the year 2020, Ruaan Botha was the one who established Revio. Botha, a seasoned professional who has spent more than a decade working in South Africa’s banking and insurance industries, came up with the idea for Revio after witnessing the amount of time and manual effort that businesses invest in engaging customers on outstanding and failed payments. He made the decision to launch Revio as a result. It was very evident that a very small percentage of businesses had invested significantly in revenue recovery. When asked where they would invest $1 if they had to restore their payment systems, the majority of over 25 clients answered they would spend at least 90% of that money on controlling payment failures and customer attrition. This was in response to the question of where they would invest $1.

In a statement by Botha: “We have the debit order as the largest recurring payment method in South Africa. But the moment businesses want to start adding other different payment methods to deal with customer demand, it was super hard for them to do so,” Botha told TechCrunch in an interview. “And it was just because of the disconnect between banks, new fintechs and payment aggregators which also made it difficult for businesses to collect recurring revenue on an ongoing basis. So with Revio, we wanted to make it super simple for businesses to connect any payment methods that they need, not only in South Africa but the rest of Africa and globally as well.”

Other Fintech Companies to Secure Funds aside Revio

In a funding round, Revio won $1.1 million in seed funding. The funding round was led by the fintech investor Speedinvest, and it included participation from Ralicap Ventures, The Fund, and Two Culture Capital. According to a statement that was made public by the business, more angel investors took part in the funding round. These investors include payment and revenue recovery specialists from Sequoia, Quona Capital, and Circle Payments.

Bloc partners with SMEDAN to provide fintech to Nigerian SMEs

Th Running of Revio

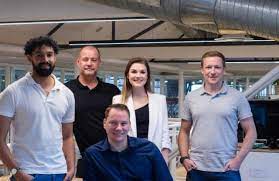

Botha is joined by three other executives who run the company’s affairs, Chief commercial officer Pieter Grobbelaar, who previously worked as a country lead at Flutterwave, Chief Technology Officer Kyle Titus, who has experience working with fintechs and a venture studio; Chief Product Officer Stefan Griesel, who has over 8 years of experience working with fintech products, and Chief Operating Officer Nicole Dunn is a venture builder and operator that has worked with multiple African startups.

According to Dunn, Revio is able to aggregate and orchestrate over a wide variety of payment methods throughout Africa. Some of these ways include mobile money, vouchers, QR codes, bank transfers, and debit orders.

Through the use of payment providers such as Flutterwave, Paystack, Ozow, and Stitch, the platform is able to collect and handle payments in more than 40 different markets. In addition to supporting a variety of payment methods, it is equipped with features such as intelligent payment routing, automatic billing procedures, auto-retirements, and real-time analytics and reporting.