The lending apps that have evolved in response to the demand for fast cash, salary advances, etc., have been called “loan sharks” by the media due to their extreme and unprofessional methods of persuasion.

In hopes of being seen by Nigerians in need of quick cash, they hack WhatsApp, hang out in gadget stores, and spend a lot on targeted advertising. The customer’s contacts receive shady messages if they don’t pay back the loan.

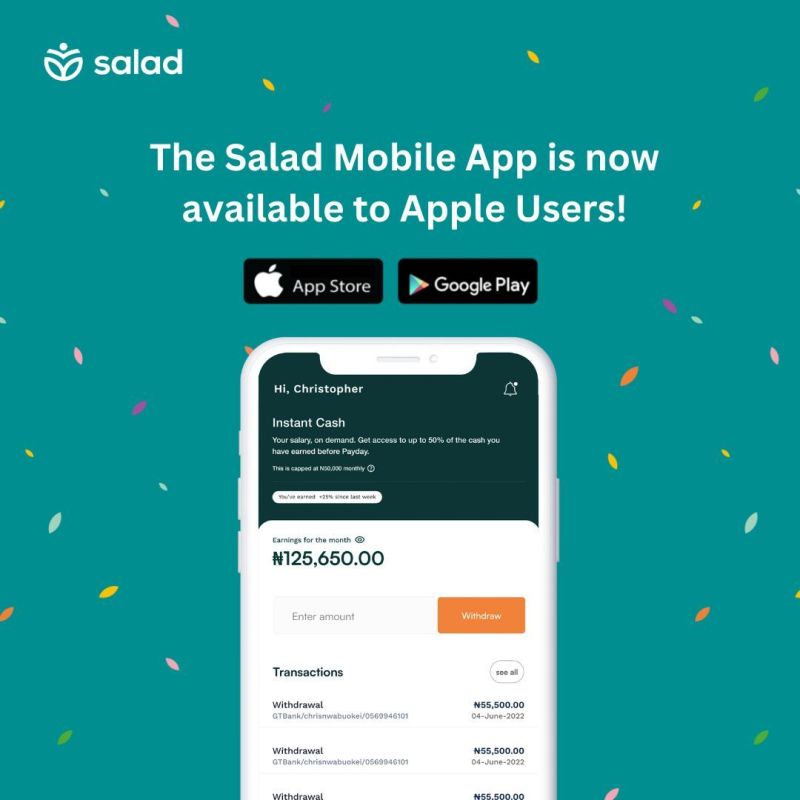

However, Salad Finance came with an offering to alter work in Nigeria and Africa. Salad Finance, a startup from the ARM Labs Lagos Techstars Accelerator Program’s first cohort, was recently previewed.

The startup gives workers part of their pay before they get paid. This applies in a country where most individuals get paid monthly.

According to Techstars salad, it provides “employees with access to financial services and benefits beyond their monthly paychecks.”

Salad Finance CEO Chikodi Ukaiwe stated, “We are providing employees in Africa with the financial services they need to live their best lives.” “We provide tools to access, save, and manage money easily and cost-effectively.”

Read also: Kenya’s Workpay raises $2.7M Pre-Series A funding

Salad Finance versus other lenders

Due to its ties with employers, Salad Finance differs from other lenders. This enables the product to determine which team members are eligible and which team members can receive salary advances.

“We are able to do this by partnering directly with their employers for prequalification and collection,” the CEO said.

After leaving the bank for a higher-paying position, Chikodi Ukaiwe found himself in a corporate environment without overdrafts or loans. This puzzles him.

“Why aren’t more people fixing this problem?” he said.

He said he made little money at the bank. I had overdrafts and now pay late fees to support my lifestyle. I could no longer access this money after switching jobs, even if I was earning more. “The problem started there.”

Salad Finance will reach 400 million hourly workers on the continent.

It affects 400 million African workers. “Despite our consistent salary, we cannot access the finances we need to live,” Ukaiwe stated.

Salary workers have had alternative means to get money before payday. The CEO stated those methods are not appropriate now.

“Bank processes are lengthy. He claimed opportunity lenders are too expensive, and borrowing from relatives and friends is uncomfortable.

Salad Finance is still having trouble keeping employees because young Nigerians are leaving the country’s struggling economy even as it offers this product to wage earners.

As a founder, outsourcing is a problem. He said, “Africa is gifted with so much potential, and it’s truly tragic to see them practically impossible to control.”

In the meantime, he wants Salad Finance to be an African professionals’ financial partner. “We want Salad Finance to be the financial partner that works with African employees across their career life and even after that.”

How does Salad Finance Operate?

This is a simple, step-by-step tutorial on how to sign up Salad users, both employers and employees.

-

Onboarding new employees

An account is created by the employer on the platform, and verification usually takes 24 hours or less.

-

Setup of payroll

Employers make or upload payroll for the business using Salads payroll applications.

- Activate the employer code

Salads produce an employer code and send it to the business through email.

- Employees get access to salads

Workers can enter the employer code by dialling *347*252# to continue.

Salad provides financial services and perks for Africa’s workforce. The fastest-growing youthful population in the world will bring more tech-savvy digital natives into the workforce in the coming years. Salad helps workers spend, save, and manage their wages. We also assist organizations in establishing amazing teams with highly engaged and productive employees.