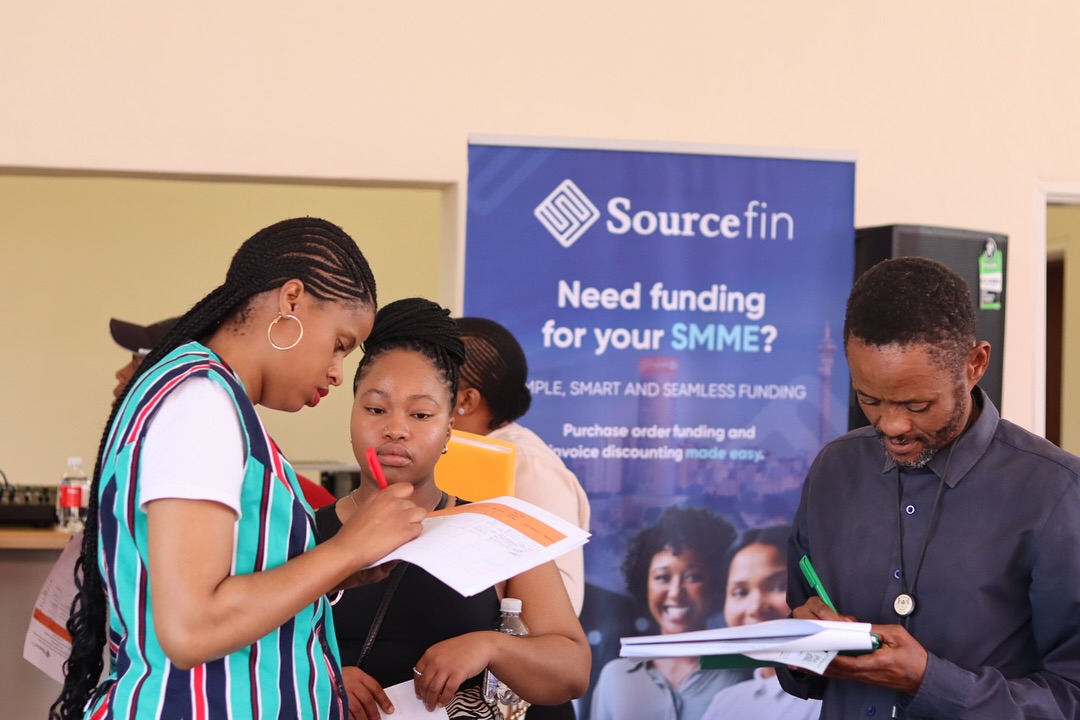

Sourcefin, a South African fintech company, raised $8.2 million (ZAR 150 million) in funding from Futuregrowth Asset Management, according to a statement on Wednesday.

This significant investment aims to enhance access to financing for small and medium-sized enterprises (SMEs) in South Africa, a sector crucial for economic growth and job creation in the region.

Read also: MTN seeks banking licence in South Africa

Empowering SMEs in South Africa

Sourcefin, founded by Brandon Roberts in 2020, is a key player in the alternative funding landscape. The company focuses on providing innovative financial solutions tailored to the unique needs of SMEs, which often struggle to secure traditional bank loans due to stringent requirements.

Roberts emphasised the importance of this funding round, stating, “This investment will allow us to expand our reach and provide much-needed financial support to underserved businesses across South Africa.”

The need for enhanced financing options for SMEs cannot be overstated. According to various reports, SMEs contribute significantly to the South African economy, accounting for about 60 percent of total employment and roughly 34 percent of GDP.

However, many of these businesses face barriers in accessing capital, which limits their growth potential. With the new funds, Sourcefin plans to develop more flexible lending products and improve its technology platform to streamline the application process for potential borrowers.

Read also: CBN to fine banks N150 million for selling mint naira notes to currency hawkers

A vision for growth

The investment from FutureGrowth is not just a financial boost; it also reflects a growing recognition of fintech companies’ role in driving economic inclusion.

Futuregrowth’s commitment to supporting innovative financial solutions aligns with its broader mission of fostering sustainable development in Africa.

“We believe in investing in companies that are making a tangible difference in their communities,” said a spokesperson from Futuregrowth.

Sourcefin’s approach combines technology with personalised service, enabling them to assess creditworthiness using alternative data sources.

This strategy caters to businesses with limited credit history but strong growth potential. As Roberts noted, “By leveraging technology and data analytics, we can make informed lending decisions that traditional banks might overlook”.

Sourcefin’s successful funding round is a key moment for the company as it aims to scale operations and impact more SMEs in South Africa. This capital will help enhance its offerings and boost economic empowerment for small businesses in the region.