Teranga Capital, a private equity firm based in Senegal, disclosed on April 16 that it had secured an initial CFA 2 billion (approximately USD 3.4 million) in fresh capital to expand its investment operations outside of Senegal.

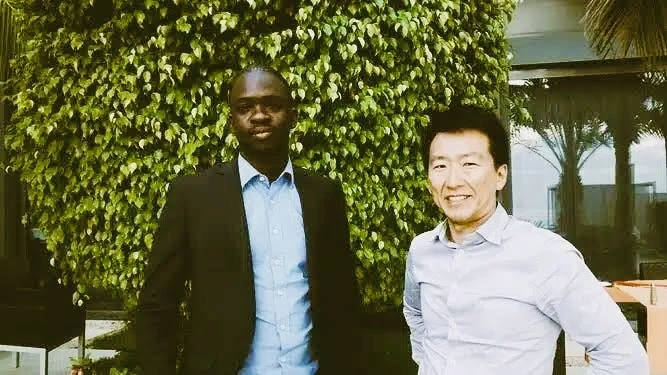

This funding begins an expected CFA 5–6 billion fundraising effort. The firm’s co-founders Olivier Furdelle and Omar Cissé, Senegal’s sovereign wealth fund FONSIS, and pan-African investor Investisseurs & Partenaires (I&P) through its IPDEV2 fund led the round. The Dutch government’s Challenge Fund for Youth Employment (CFYE) and individual investors, including Julie Dumortier via Aceblue, are additional supporters.

Following a general assembly in late March 2025, Teranga Capital’s shareholders authorised the expansion of the firm’s mandate to increase the scale of investments and geographic coverage. The maximum ticket size will expand to CFA 1 billion (€1.5 million) to fulfil growing demand from Senegalese and regional SMEs. Teranga Capital wants to reinvest in its best portfolio firms selectively.

Teranga Capital targets Mauritania, Guinea-Bissau, and Cape Verde markets

Teranga Capital, which was established in 2016, has concentrated on early-stage investments in Senegalese SMEs and entrepreneurs, particularly emphasising local value creation in sectors such as agribusiness, health, and logistics. The company offers hands-on operational support in addition to equity and quasi-equity financing.

The firm expanded into Mauritania, Guinea-Bissau, and Cape Verde to enter neglected West African regions that international private equity has ignored. Teranga Capital sees these countries as natural extensions of its regional network and believes its localised proximity investing methodology may create considerable opportunities.

These markets have insufficient infrastructure, restricted exit alternatives, and complex regulations, notably in Guinea-Bissau and Mauritania, but Teranga Capital’s local experience and tight relationships with founders can alleviate risks.

The firm aims to begin scouting investment opportunities in the new countries by the end of 2025 and is actively engaging additional investors for the second close of its fundraising. Beyond the well-known centres like Nigeria, Ghana, and Côte d’Ivoire, this approach might persuade other regionally oriented investment businesses to investigate West Africa’s underserved markets.