While cryptocurrencies like Bitcoin are known for volatility, stablecoins are different. Pegged to stable assets like the U.S. dollar, they provide a reliable digital alternative to local currencies, unlocking new possibilities for millions of people’s commerce, savings, and cross-border transactions. For this reason, exchanges such as Tether are heavily investing in stablecoins across Sub-Saharan Africa.

In 2024, Chris Maurice, the CEO and Co-Founder of Yellow Card, one of Africa’s biggest crypto exchanges operating in 20 countries, highlighted this trend.

He noted that around 70 per cent of African countries are facing a shortage of foreign exchange, making it hard for businesses to get the U.S. dollars they need. Stablecoins, he explained, give these businesses a chance to keep running, expand, and support local economies.

“About 70% of African countries are facing an FX shortage, and businesses are struggling to access the dollars they need to operate,” Maurice explained. “Stablecoins allow these businesses to continue to operate, grow, and strengthen the local economy.”

This Techpression analysis examines the rise of stablecoin use in Africa, its trading volumes, and the countries leading in adoption.

Annual crypto transaction volume $100B+

Stablecoins now account for most of the value being moved on the blockchain in Sub-Saharan Africa, with yearly transactions reaching around $100 billion. This shifts from using crypto mainly for speculation to using it as a practical financial tool.

They are no longer seen as a niche option but have become the region’s primary driver of crypto adoption. Their steady value makes them more useful for daily financial activities, outshining volatile assets like Bitcoin.

In our analysis, stablecoins account for about 65 per cent of crypto transactions by volume in the region. Bitcoin follows at 25 per cent, while other altcoins account for just 10 per cent.

The rise in adoption has been fueled by strong demand at the grassroots level and a mobile-first population. The growth in transaction volumes points to a lasting trend toward digital currency use.

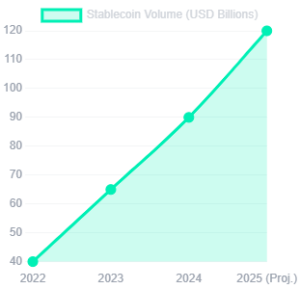

Looking at growth over time, stablecoin volume was about $40 billion in 2022. By 2023, it had climbed to roughly $65–$67 billion. The upward momentum continued in 2024, reaching close to $90 billion. Based on this pattern, the project figures could hit about $120 billion by the end of 2025.

Why the surge? Key use cases in Sub-Saharan Africa

The growth of stablecoins in Africa is not fueled by speculation but by their real usefulness. They help solve everyday financial challenges for individuals and businesses, from protecting against inflation to making international trade easier.

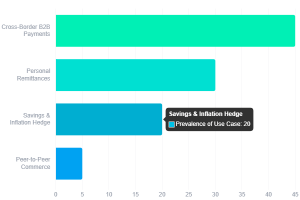

Cross-border business payments

The most significant use case for stablecoins is Business-to-Business (B2B) payments, which account for about 45 per cent of their use.

Companies rely on them to handle international transactions faster and cheaper than traditional systems.

Personal remittances

The second major use case, about 30 per cent, is money transfers from individuals to family and friends across borders. It offers a cheaper and quicker option than traditional money transfer services.

Savings and protection from inflation

About 20 per cent of users turn to stable currency to save money and protect their wealth from devaluation and inflation. Most are tied to the U.S. dollar, which holds its value better than local currencies.

Peer-to-peer trade

This is the smallest use case, at around 5 per cent. While stablecoins can be used for everyday purchases and payments between individuals, they are not yet as widespread as other uses.

Lastly, sending money through traditional systems usually involves multiple banks and intermediaries, takes 2 to 5 days, and has fees ranging from 5 to 10 per cent.

With stablecoins, the process is much more straightforward: money moves directly from the sender’s wallet to the recipient’s in minutes, with fees usually under 1 per cent.

The countries leading in Africa

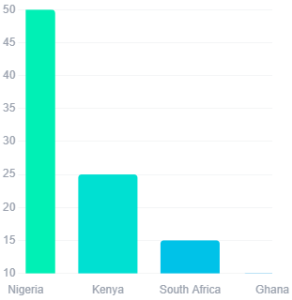

Stablecoin use is growing across Africa, but a few countries stand out as the main hubs of activity. Nigeria, Kenya, and South Africa are leading the way, mainly because of their young, tech-savvy populations and strong links to international trade.

Nigeria

Nigeria is far ahead of the rest, holding the top spot with the highest level of adoption. Scoring a value of 50 per cent, it is the main centre of stablecoin activity on the continent.

This growth is fueled by widespread technology use and ongoing financial challenges that make digital currencies attractive.

Kenya

Kenya comes second with a score of about 25 per cent, showing it is also a strong stablecoin market, though its activity is only about half of Nigeria’s.

South Africa

South Africa ranks third, scoring around 15 per cent. Its adoption is meaningful but still far behind Nigeria and Kenya.

Ghana

Among the four, Ghana has the lowest stablecoin activity with a score close to 10 per cent, showing that adoption here remains relatively limited compared to the others.

The two titans: USDt vs. USDC

In Africa’s stablecoin market, Tether (USDT) is far ahead of the competition. Thanks to being the first to launch and its strong liquidity on peer-to-peer exchanges, it dominates the space. Still, USD Coin (USDC) is slowly gaining ground as a trusted and more regulated option.

Tether (USDT)

Represented by the green sector, Tether controls about 80 per cent of the market. This shows its clear dominance and confirms its leading position among stablecoins in the region.

USD Coin (USDC)

The blue sector shows that USDC holds the remaining 20 per cent share. While this is a solid presence, it still places USDC well behind Tether.

The rise of stablecoins in Sub-Saharan Africa shows how technology is helping solve real-world financial problems.

As regulations become clearer and digital infrastructure develops further, stablecoins are expected to play an even bigger role in creating a more inclusive and efficient regional economy.