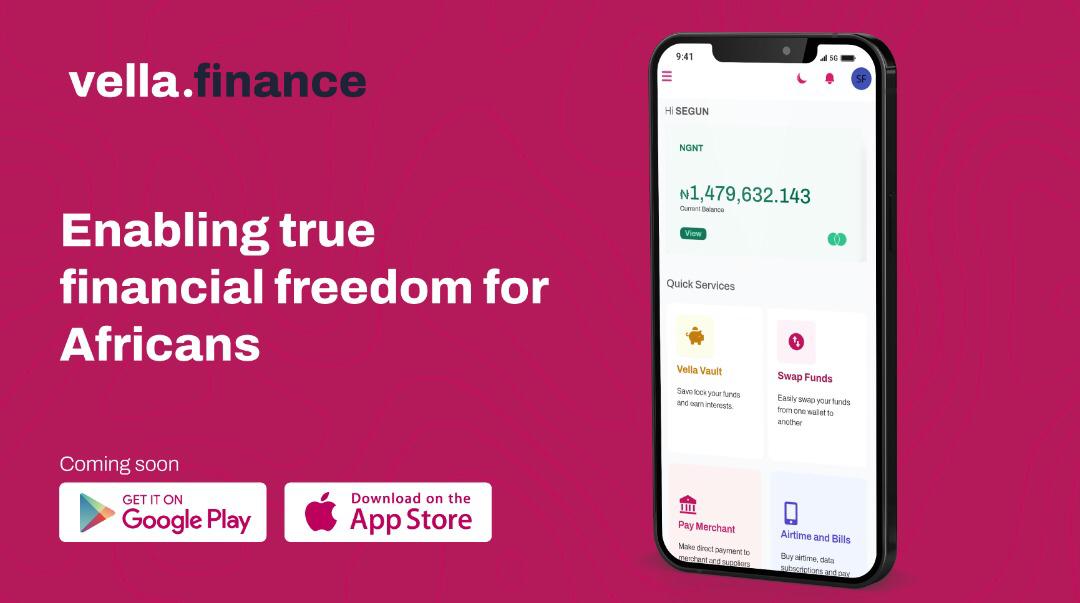

One of Nigeria’s fastest-growing fintech companies, Vella, has unveiled its money transfer platform, which it says would enable it to execute international transfers and remittances anywhere in the world.

Vella co-founder Tolu Adebayo asserts that the platform will be able to “become a facilitator and an enabler for crypto usefulness and spend-ability throughout Africa” because to its use of cryptocurrency.

Since its beta introduction in 2021, Vella has successfully onboarded more than 250 users and completed more than 230 transactions totalling more than $20,000.

According to Adebayo, “Vella is positioned to become a facilitator and an enabler for cryptocurrency utility and spend-ability in Africa, delivering both fiat and cryptocurrency rails to power remittance and payments for African people and businesses.”

A genuinely borderless payments infrastructure and crypto utility system have not been created, despite fintech’s growing popularity in Africa, and Vella is working to change that. Vella Finance offers a range of services. Of course, the major service is money transactions, which are frequently free on the platform. While sending and receiving money is free, users can rapidly complete transactions.

Read: Yellow Pay Introduces New Payment Option

Additionally, Vella has a function that looks like a wallet and lets users receive bitcoin and convert it to cash. Tolu asserts that everything was completed immediately. “Since we don’t operate on a peer-to-peer network, you may instantly convert any bitcoin you get into cash.” Tolu is anxious.

Vella assesses a small transaction fee for this service based on the volume of the cryptocurrency being traded.

Additionally, according to Tolu, fintech provides corporate users with competitive exchange rates. Our dollar exchange rates right now range from 535 to 545. Although it depends on the market, our prices are unquestionably reasonable.

Soon, everyone will be able to use Vella Finance’s mobile applications. Among the services that will be available are Airtime4Cash, gift cards for cash, and the development of virtual cryptocurrency cards. The startup will also make its payment API available to businesses. The products will automatically receive updates every three to six months.

KYC and BVN requirements are part of the onboarding processes for new users, whereas KYB, a certificate of company registration, and a tax identification number are part of the onboarding processes for businesses. Vella Finance launched a test phase a few weeks ago and has more than 250 subscribers. Furthermore, it has successfully completed over 230 transactions for over $20,000 overall. For a startup at this stage, this is a tremendous accomplishment. Tolu asserts that the crew gained a lot of knowledge during the period.

Vella’s Potential Impact on Border Transactions

Nigerian fintech companies have dramatically upset the old banking system, but cross-border transactions are still an expensive and time-consuming problem.

Even today, most platforms that provide these services require 2-4 days to complete a cross-border payment. Most platforms, especially peer-to-peer ones, are either inaccessible to Africans or have significant limitations.

Unlike WorldRemit, these services enable Nigerians to receive money from abroad but not to send it. Due to a partnership with Flutterwave, Africans have only recently been able to accept donations using Paypal.

Additionally, transaction costs and exchange rates are frequently outrageous. Compared to the global average of 6.5%, the cost of a cross-border service is on average 9% of the overall transaction value in Africa.

Remittances from the diaspora are Nigeria’s second-largest source of foreign exchange earnings. According to the Central Bank of Nigeria, remittances from the diaspora fell by 27% this year from $23.5 billion last year to $17.2 billion.

Commercial financial institutions offer incentives, like low transaction costs for remittances, to stimulate this flow of money. This does not, however, address the problem with international transfers.

Is Vella reliable?

By enabling the intended real user (the end-user) to evaluate the product’s functionality, usability, dependability, and compatibility, beta testing, one type of acceptance testing, adds value to the product. Feedback from customers helps a product succeed by enhancing its quality.

Users do not have access to this data because sure of Vella’s services are based on system integration with third-party APIs. During the beta testing period, when the airtime purchasing feature briefly went down, some consumers shifted money even though an email was sent to apologise.

Users’ impatience is understandable because it results from their fear, but it can be detrimental to a firm that is just starting out. Therefore, the first lesson is to avoid situations that can make users nervous.

The second lesson is the importance of utility and the need to avoid sacrificing it. The final lesson, according to Tolu, is that executions are challenging in Nigeria. This assertion is confirmed by the Central Bank of Nigeria’s most recent notification regarding freezing cryptocurrency accounts, which was made just one week into the beta phase. Managing or staying ahead of these regulations is a huge task.

Both short-term and long-term market and product expansion are objectives for the startup. Following their success in Nigeria, they will offer their services, among other countries, in South Africa, Ghana, Kenya, Botswana, and Zimbabwe.