Lagos and Helsinki-based ZirooPay has recently raised an $11.4 million Series A round led by Lagos-based VC fund Zrosk Investment Management. Existing investors Nordic venture fund Inventure returned, with participation from other private and institutional funds such as Fedha Capital and Exotix Advisory.

Also partaking in the round are individual investors like Petri Kivinen, the former managing director at Deutsche Bank, Morgan Stanley, and Renaissance Capital; Abiodun Ajayi, the director, Sub-Saharan Africa of Bank of America; Kurt Bjorklund, managing partner at Permira; Stephane Kurgan, venture partner at Index Ventures; and Jonas Dromberg, former Bureau chief at Bloomberg.

The State and Adoption of POS Terminals in Nigeria

According to Statista, the number of POS terminals in Nigeria increased from 150,000 in 2017 to 543,000 in April 2021. The amount of POS payments in the country has expanded dramatically, reaching more than 500 billion in May 2021.

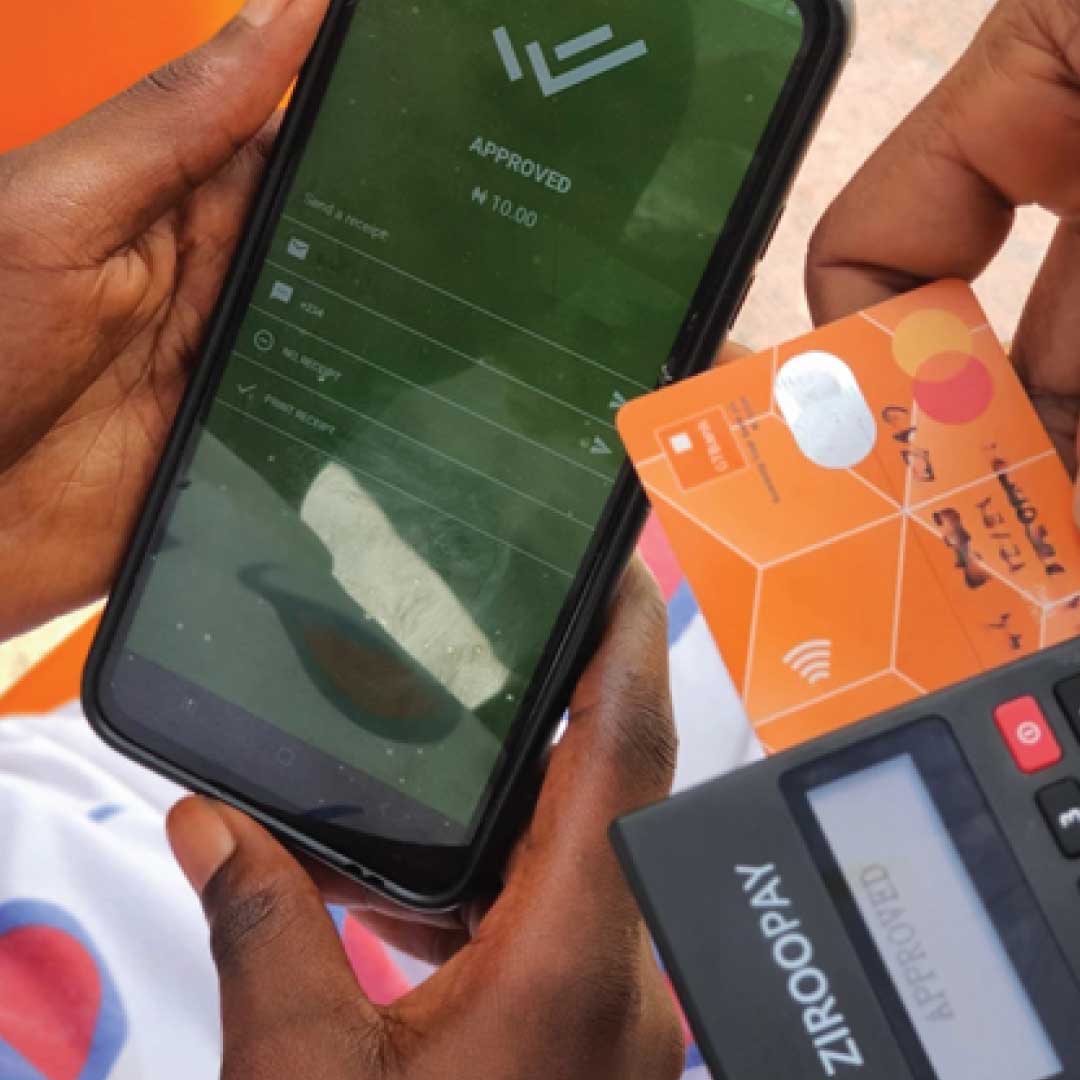

POS terminals are used in Nigeria to handle card payments at retail outlets and agency banking, a branchless banking system in which agents operate as human ATMs. While terminals have a variety of providers (banks and fintechs) and functionalities, they all work primarily online, with only a few having offline capabilities.

Read Also : Visa Unveils Its First African Innovation Studio in Kenya

In 2014, when IroFit (ZirooPay’s parent company was launched) raised $600,000 funds, its pitch then was that its “Internet-free” tech — a mobile platform for small businesses to accept card payments via a mobile app and EMV-certified card reader — operated in areas where there is no data coverage, particularly in emerging markets. At that time, the company was solely based in Helsinki.

The CEO, Omoniyi Olawale, revealed that the funds it raised ($600,000 in seed) would initiate a launch in Nigeria. However, it was five years before the company launched in Lagos. Olawale informed that the delay was because the company was fine-tuning its technology and adding more capabilities to its features, having further received $2 million.

That pitch hasn’t altered, and ZirooPay has grown tremendously in its three years of existence. Over 15,000 merchants use the company’s POS terminals and mobile app, according to the company. According to the company, these merchants have completed $500 million in 10 million transactions, a 5,000% increase within three years.

The percentage of transaction failures owing to a poor internet connection is one of the most significant barriers to the widespread adoption of card payments at retail locations. “As a result of that, we created our in-house technology, which we have a patent for, which allows us to process those events in real-time without an internet connection,” Olawale said of his decision to make ZirooPay an offline-first service.

Read Also : How To Turn off Auto-Playing Videos On Facebook

“So the product got built around that major problem; we can provide a 95% transaction success rate against the less than 50% that you find in the market,” he added.

The second major issue for POS terminals is functionality, or what other functions they can provide other than payment processing. Every customer interaction with a retailer or an agent is a data mine for payment processors and merchants. However, because POS terminals rarely have bookkeeping capabilities, retailers are more likely to manually reconcile their accounts regularly or rely on Khatabook-Esque platforms like Kippa to digitise their processes.

Merchants who use ZirooPay’s platform, on the other hand, wouldn’t have to look elsewhere. According to Olawale, the company’s mobile application enables small businesses in the retail, agency banking, hospitality, and services sectors to do similar tasks, such as tracking sales and managing operations.

“Think about everything that the cash registers seen in big supermarkets can do; with an Android application and a mobile point-of-sale card reader, we provide that same functionality to small businesses,” he remarked.

“We’ve seen over 70% of our users migrate from paper-based accounting to depend on the in-app sales accounting within three months of onboarding.”

Expanding POS Solution in Nigeria

In order to build up an omnichannel system for retailers, ZirooPay will use the new growth funding to expand its product suite and incorporate additional payment channels and options. And, as POS providers in Nigeria, particularly fintechs, increasingly focus on agency banking —a substantial fintech segment that fosters financial inclusion — ZirooPay sees an opportunity to dominate an open retail space.

According to Olawale, “No major company is coming in with modern technology trying to tackle this space, and that’s one area that we see an opportunity for us because we are primarily a retail payment platform. Even though we provide agency banking on the side, our focus is on retail, and that’s something that differentiates us from the other players.”

Samson Esemuede, the managing director and chief investment officer of Zrosk, said of the investment: “The growth in the online economy of the African continent has been remarkable; however, the offline economy is orders of magnitude larger than the online economy.

“ZirooPay has a patented technology advantage (that works without an internet connection) and distribution model that significantly increases the odds of digitising the offline economy at a unit cost, making the story particularly compelling. The payment space has become well-resourced and competitive, but the white space we see in the digitisation of cash is why we are optimistic about the outlook for this investment.”