The American multinational software company Adobe Inc. has reached a deal to buy the cloud-based design tool Figma. According to the announcement made by Adobe, the acquisition deal is approximately $20 billion in cash and stock.

Over the past few years, Figma has become known as a cutting-edge, collaborative design platform that is a strong competitor to Adobe, which is the leader in creative tools. The conflict was resolved on Thursday when Adobe declared victory.

What does Adobe acquiring Figma mean?

With this acquisition, Adobe will be able to add Figma’s popular design tools to its wide range of creative apps. But the acquisition also means that Adobe will once again take a major competitor off the market and bring it under its own umbrella. This upsets many designers who use the tool and are worried about another important platform joining the company’s Creative Cloud service. And they have a point: now that Figma is off the market, the number of companies that can challenge Adobe’s empire has shrunk significantly.The company has said that it may need to get a loan to make this purchase, and it has given a gloomy outlook for the next year.

The company’s sales of $4.43 billion and its non-GAAP profits per share of $3.40 in Q3 were higher than expected. The company has stated that it may need to take out It has issued a timid forecast for the next quarter, predicting $4.52 billion in revenue and $3.50 per share, citing “the overall macroeconomic environment” and “FX headwinds” as the reasons. While Adobe probably thought that the announcement of the consolidation and removal of competition would increase its stock price,

How will the deal go?

Adobe said that the deal would be half cash and half stock, and it will also include 6 million additional restricted stock units that will be given to Figma’s CEO and employees. After closing the deal, these units will be fully paid over the next four years. It will likely end in 2023, “subject to the receipt of required regulatory clearances and approvals and the satisfaction of other closing conditions, including the approval of Figma’s stockholders.”

Read also: Bboxx Acquires Ghana solar energy provider, PEG Africa

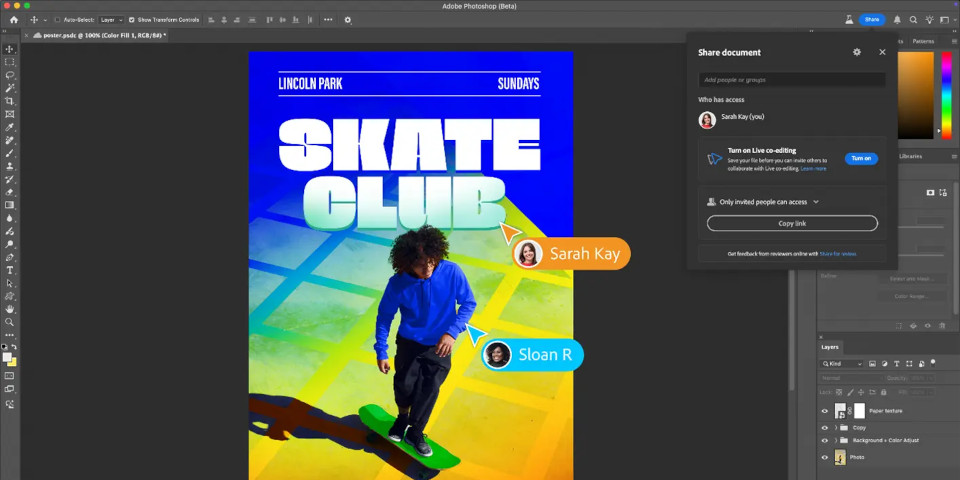

Figma’s product strengths are design and prototyping, which can be done by individuals or teams in a modern, cloud-based environment. To date, it has about 4 million users. Adobe has been building and buying a number of businesses in the wider world of digital creation. This has taken it not only into the larger and more general areas of design but also into marketing and other areas close to design in the longer creation chain. Adobe’s core business, though, is design, and it has made many well-known products in areas like imaging (with Photoshop), fonts, illustration, video, 3D, and more.

Now, the plan is to make a smooth connection between them and Figma, making it more or less the native platform for bringing everything together. Adobe already had something similar, which was called AdobeXD. It’s unclear what will happen to that once this deal is done.

What are they saying?

Shantanu Narayen, chairman and CEO of Adobe, said, “Adobe’s greatness has been rooted in our ability to create new categories and deliver cutting-edge technologies through organic innovation and inorganic acquisitions.” He also said, “The combination of Adobe and Figma is a game-changer and will speed up our vision for creative collaboration.”

Dylan Field, co-founder and CEO of Figma, also said, “With Adobe’s amazing innovation and expertise, especially in 3D, video, vector, imaging, and fonts, we can “We further reimagine end-to-end product design in the browser while building new tools and spaces to empower customers to design products faster and more easily.” According to the published blog post, he affirmed that he would continue in his position even when the acquisition closes, but his new line of reporting will be to David Wadhwani, head of Adobe’s Digital Media business, according to the published blog post. “Adobe is deeply committed to keeping Figma operating autonomously.”

Read also: Ghana’s Float Acquires Nigeria’s Accounteer

Users’ reactions to this acquisition

On social media, users were quick to respond. There are, of course, a lot of memes, and many of them aren’t exactly happy. Many people have dug up an old tweet that Field posted in January 2021. In it, he said, “Our goal is to be Figma, not Adobe.” Others have said they might switch to competing UI design tools like Sketch, and some are scared that the free version may turn into a free trial.

When Adobe bought Figma https://t.co/5PxOA9EZxI

— Val Pieŭnioŭ (@mamkindesigner) September 15, 2022

Hope this won't happen pic.twitter.com/GU7xNd1DG1

— ˗ˏˋ vyshnav ˊˎ˗ (@vyshnav_xyz) September 15, 2022

Imagine that tomorrow you wake up and see this. Your actions? pic.twitter.com/144mlIG9uw

— Anton Lapko (@anronkai) September 15, 2022

Observations

Since it became public in 2016, Figma has quickly become one of the best-known online tools for designing user interfaces and user experiences.

It is said that Figma’s total market potential will be $16.5 billion by 2025, and “the company is expected to add approximately $200 million in net new ARR this year, surpassing $400 million in total ARR by 2022, with best-in-class net dollar retention of greater than 150 per cent.” With gross margins of about 90% and positive operating cash flows, Figma has built a business that works well and is growing quickly.

This purchase undoubtedly raises the stakes for other prominent players in the digital design field. In particular, it will be fascinating to see what the future holds for companies such as Canva and Sketch.

It is lauded for having a simplified form and a collaboration feature.