The Nigerian central bank has had a patchy record regarding cryptocurrencies, and this crackdown runs against a 2021 decision to make opening cryptocurrency accounts easier.

Some Nigerian financial companies have warned customers against utilising their accounts for crypto transactions or face severe consequences as the country regulates cryptocurrency.

Read also: OPay, Kuda, Moniepoint, others pause signups amidst CBN probe

Nigerian Fintechs Writes to Crypto Users

Customers who assist crypto transactions with Nigerian fintech firms Moniepoint, PalmPay, and Paga will have their accounts closed. This follows the CBN ordering some new banks, notably Moniepoint, to stop onboarding customers.

In the message sent to clients on May 2, 2024, Moniepoint stated:

“By CBN regulation, we will close the account of anyone trading crypto or other virtual assets and share their details with relevant authorities.”

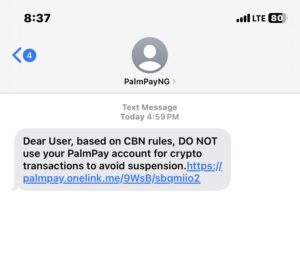

Palmpay informed clients that following CBN rules, they should not utilize their accounts for crypto transactions to prevent suspension.

The Central Bank of Nigeria (CBN) has retracted its prior announcement that it would relax its prohibition on cryptocurrencies in 2021. The Central Bank of Nigeria (CBN) issued a circular in December 2023 that authorised financial institutions to register accounts, provide settlement services, and function as middlemen for businesses dealing in crypto assets or cryptocurrency.

The December circular replaces the 2017 and 2021 circulars that banned banks from opening cryptocurrency service provider accounts.

An X user and PalmPay client reported his account was frozen and would only be unfrozen if he signed an agreement banning crypto transactions.

Paga also informed customers that the CBN licences it and that it will follow all regulations:

The CBN circular referencing FPR/DIR/GEN/CIR/06/10 prohibits trading in or assisting transactions in Bitcoin and other virtual currencies.

Paga cites a 2017 circular warning banks and other financial institutions about their relationships with cryptocurrency exchanges and users.

The CBN denied a report that it ordered all banks and financial institutions to identify entities trading with cryptocurrency exchanges and put such accounts on “Post No Debit” for six months.

The circular prevented regulated financial institutions from processing crypto exchange payments.

Read also: Noones Academy Empowers Nigerians with Cryptocurrency Trading Education

The Future of Nigerian Fintech and Crypto Users

Fintechs and cryptocurrencies need cooperation and regulatory certainty to coexist. The Nigerian government must embrace fintech and crypto assets. Regulatory frameworks should promote innovation, consumer protection, and financial stability.

Lastly, the conflict between cryptocurrency users and Nigerian fintechs represents the global conflict between traditional finance and decentralised alternatives. Collaboration and innovation are essential to Nigeria’s financial ecosystem’s potential as players negotiate regulatory uncertainties and technological upheavals. In this changing world, fintechs and cryptocurrencies can only prosper via communication and adaptability.