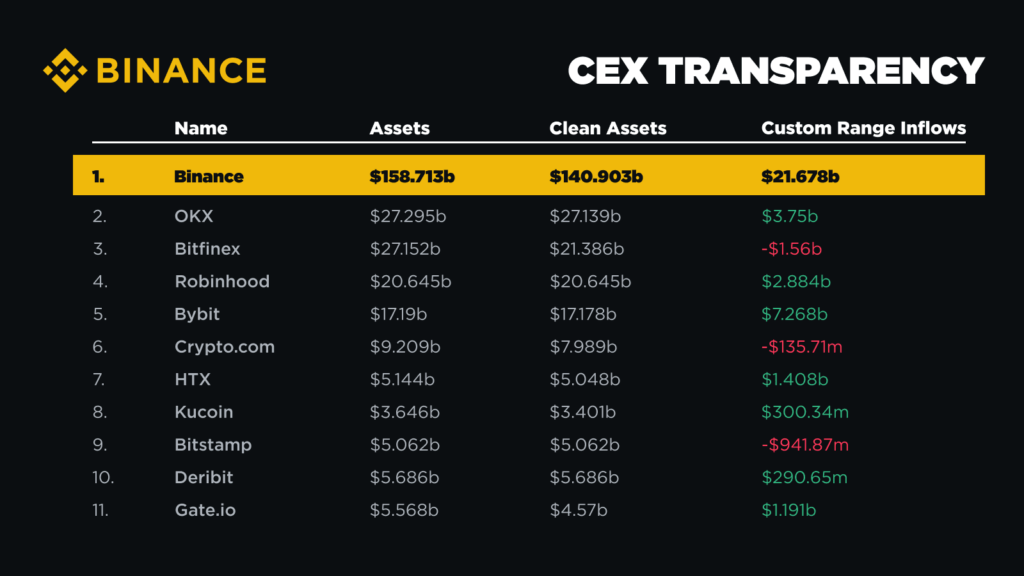

The largest cryptocurrency exchange in the world, Binance, reported a sharp rise in customer fund deposits in 2024, hitting $21.6 billion.

Citing information from DefiLlama, a company that offers analytics and data pertaining to decentralised finance, the digital currency platform disclosed the information in a statement on Thursday.

Compared to the $15.9 billion total that the next 10 cryptocurrency exchanges recorded, this amount represents a 36 percent rise.

“Binance recorded $21.6bn in user fund deposits in 2024—nearly 40 per cent higher than the $15.9bn combined inflows of the next 10 exchanges in the ranks,” the blog post read.

Read also: Binance, AltSchool Africa offer tech scholarships to 500 young Africans: How to apply

Increased deposits attributed to growing interest in digital assets

The increase in deposits, according to the exchange, is a result of institutional and corporate investors’ increased interest in digital assets. While USDT deposits increased from $19.6k to $230k, Binance’s average Bitcoin deposit across exchanges increased from 0.36 BTC in 2023 to 1.65 BTC in 2024.

“Binance’s growth aligns with a surge in global adoption of digital assets. Major regulatory wins, historical price milestones, and the approval of Bitcoin ETFs in markets such as the United States, Brazil, Hong Kong, and Australia have bolstered institutional and retail confidence,” the blog post stated.

“These developments have driven millions of users to Binance, increasing its global user base to almost 250 million people,” it emphasised.

New era for digital assets

Binance CEO Richard Teng commented on the company’s milestone, stating, “2024 has been a landmark year for the crypto industry, and we are incredibly grateful to our nearly 250 million users, who continue to trust Binance as their chosen platform for trading.”

Teng also outlined a number of elements that have contributed to the platform’s success, such as significant legislative victories, the acceptance of Bitcoin exchange-traded funds, and the growing popularity of cryptocurrencies around the world.

“The introduction of Bitcoin ETFs has played a crucial role in institutional growth,” Teng added.

“Binance’s continued innovation and transparency, along with user-first initiatives, signal a new era for digital assets,” Teng stated.

Read also: Bitcoin hits record highs, eyes $100,000 milestone

Binance face-off with Nigerian government

Binance halted its crypto trading services in Nigeria earlier this year following a run-in with the Nigerian government which led to months long incarceration of two Binance officials Nadeem Anjarwalla and Tigran Gambaryan.

The duo were charged to a federal court for allegedly sabotaging Nigeria’s economy as the West African nation grappled with currency instability and soaring inflation.

While Mr Anjarwalla escaped during the Ramadan fasting period, it took the intervention of the White House to secure Mr Gambaryan’s release.

On February 28, 2024, the site banned peer-to-peer NGN trading pairs. This action comes in response to mounting worries over Binance’s alleged involvement in the depreciation of the naira, specifically through its P2P platform, which detractors claim has aided in the devaluation of Nigerian currency.