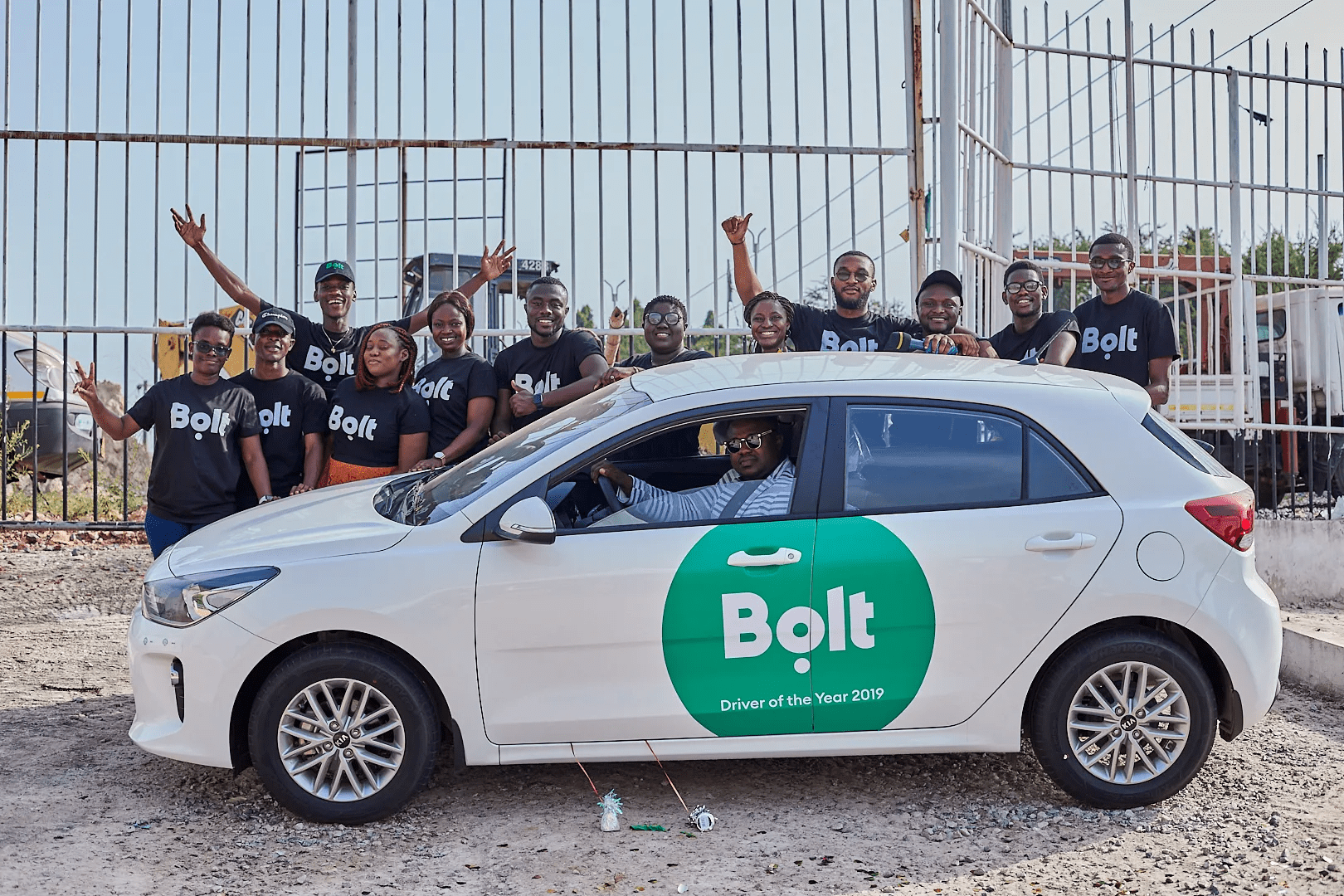

Bolt and Hakki Africa, a microfinance provider, have launched a strategic relationship to provide financing for Bolt users’ vehicles. Over the following 18 months, the collaboration plans to distribute 1,500 automobiles to Bolt platform drivers who fulfil specific requirements.

Driver-partners who fulfil the requirements will be eligible for loans with lower down payments and will be rewarded with incentives determined by their performance.

Read also: Advancly and Bolt Nigeria team up to offer drivers credit access

How does Bolt & Hakki Africa expand vehicle ownership?

For Kenyan cab drivers who may not easily access bank loans, Hakki Africa has developed a credit scoring system, in addition to other fintech options. Thanks to the collaboration between Bolt and Hakki Africa, more people, both new and old, can afford to drive their vehicles through the platform.

Studies indicate that drivers in Africa who do not own their vehicles tend to earn less than those who do. A study conducted in Johannesburg, South Africa, found that many drivers in Africa do not own their vehicles but rent them, leading to a significant financial burden.

The rental costs, along with platform commission fees, often leave drivers with minimal net earnings. For this reason, Hakki Africa aims to enable more drivers to own their vehicles and maximise their earnings.

Bolt and Hakki Africa leverage fintech for Drivers

Linda Ndung’u, CEO of Rides at Bolt, commented that they are committed to supporting their drivers by improving their financial stability and overall well-being in cooperation with Hakki Africa.

They have partnered with Hakki Africa to offer affordable and environmentally friendly car financing alternatives to accomplish this.

Read also: Shesha’s journey to becoming a local e-hailing challenger

Working together, they can make it easier for more drivers to buy their automobiles, which will boost their income, cut operational expenses, and foster a more prosperous driving community.

Yumeka Abe, director of Hakki Africa, exclaimed that they are delighted to collaborate with Bolt to offer drivers top-notch vehicle financing services on their platform.

When it comes to building credit and getting loans, their credit score methodology is a lifesaver for temporary workers who were previously unbanked. They see them as crucial to the growth and development of Kenya’s economy.

Drivers who take out loans with them will be able to acquire a car after 3.5 years of payments. Once the debt is paid off, they have many options: sell the car to start a new business, improve their net income as drivers, or take advantage of other opportunities.