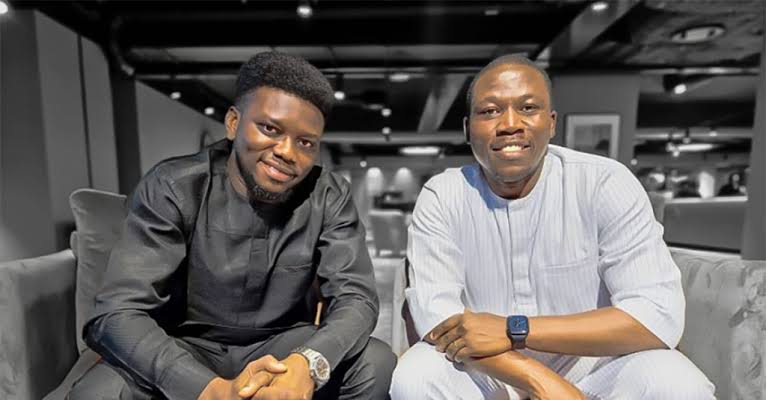

Billboxx, a Nigerian fintech startup, announced on December 11, 2024, that it has successfully raised $1.6 million in a pre-seed funding round. Founded in early 2023 by Justus Obaoye and Abdulazeez Ogunjobi, Billboxx aims to address the cash flow challenges faced by small and medium enterprises (SMEs) across Africa.

The platform provides integrated billing and payment solutions, streamlining invoicing processes to combat the inefficiencies that often plague SMEs.

Read also: Hub2 raises US$8.4 million to drive seamless digital payments across francophone Africa

Tackling cash flow issues

The $1.6 million funding, a mix of debt and equity from investors like Norrsken Accelerator and Kaleo Ventures, will be used to scale operations and enhance product features. Billboxx’s flagship service is invoice financing, allowing businesses to receive advance payment before their clients settle. This service is crucial for SMEs that often face delayed payment cycles from larger enterprises, which can disrupt their operations.

Co-founder Justus Obaoye highlighted the importance of modernising financial processes for SMEs: “We realised that many businesses face significant inefficiencies in billing and cash flow management.

Billboxx is here to modernise these processes and provide financial stability.” By automating billing and offering tailored cash flow solutions, Billboxx empowers SMEs to focus on growth rather than payment delays.

Future growth and expansion

Since launching its minimum viable product (MVP) in May 2023, Billboxx has facilitated over $4 million in invoice payments.

The platform boasts partnerships with notable enterprises such as Monument Distillers and the International Institute of Tropical Agriculture (IITA), which help integrate its services into larger corporate ecosystems. The company processes approximately ₦1 billion (around $1.3 million) in transactions monthly without reporting any defaults.

Read also: Talk360’s NjiaPay to unify payment solutions for Africa

The new funding will enable Billboxx to expand its team and strengthen its presence in Nigeria while exploring opportunities across Africa. As the company prepares to launch additional features to connect SMEs with new market opportunities, it positions itself as a vital player in enhancing financial solutions for African businesses.

With a commitment to innovation and addressing critical pain points for SMEs, Billboxx aims to redefine how these businesses manage their finances, potentially catalysing economic growth across the continent.

As co-founder Abdulazeez Ogunjobi noted, “Delayed invoice payments pose a significant threat to SME growth and survival. Our platform not only streamlines billing-to-payments workflows but also offers strategic embeddings to expedite payments.”

Billboxx’s journey reflects a growing trend among fintech startups that seek to empower SMEs by providing accessible financial solutions tailored specifically to their needs. With continued support from investors and a clear vision for the future, Billboxx will significantly impact the African SME landscape.