Technology has transformed Nigerian banking in the past decade. Opay, PalmPay, and Moniepoint have made business operations more accessible and more efficient for everyone, challenging traditional banks.

Cash payments and insufficient web infrastructure prevented enterprises from expanding beyond local demand before this disruption. Fortunately, payment and banking systems have expanded business opportunities beyond their local area.

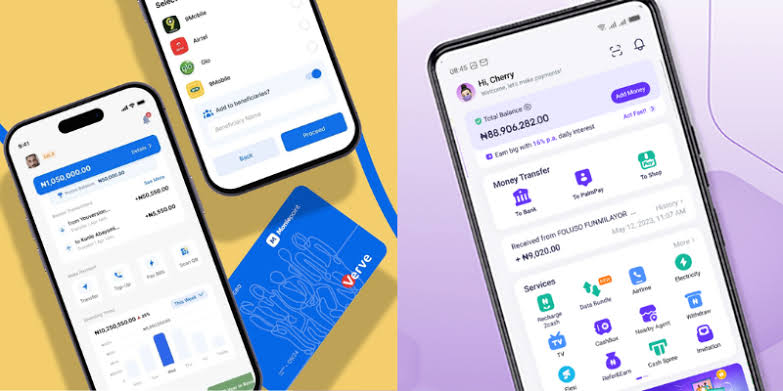

From these innovators, Nigerians trust PalmPay and MoniePoint. Although both provide financial services to clients, their unique features set them apart from other fintech platforms in the country.

Both financial systems offer similar services, yet they are different. Research, Nigerian comments, and observations show that both platforms’ excellent offerings are satisfying Nigerians and Nigerian businesses.

This article investigated both platforms’ similarities and differences. We compared comparable and dissimilar features and chose the most accessible and efficient.

Read also: PalmPay receives $677 million for 853,000 customers

Preview: PalmPay and MoniePoint

PalmPay and MoniePoint aim to provide affordable financial services to Nigeria’s unbanked. They’ve pioneered financial services with several features and perks beyond standard banking.

Palmpay has a mobile money operator (MMO) licence in Nigeria, allowing it to provide mobile money services, including mobile payment services, to both the banked and the unbanked. Moniepoint Inc. has a switching and banking license, allowing it to offer business banking services to merchants and individuals.

Moniepoint is now a microfinance bank. After expanding its operations, the company launched its app to offer personal and online banking to consumers, competing with Palmpay and Opay.

Moniepoint

The MFB has provided banking, payment processing, loans, and business management solutions to nearly 600,000 enterprises since its license. Over 400 billion transactions, totalling $12 billion, are processed monthly by Moniepoint with these solutions. Moniepoint MFB is the largest financial services distribution network in Nigeria, with support offices in 33 states.

In addition, Moniepoint Microfinance Bank provides a variety of banking services for small, medium, and big businesses. Businesses can accept card payments with their POS machines.

Monnify powers the MFB’s payment gateway. Moniepoint’s Monnify web-based payment gateway makes it easy for businesses to accept recurring or one-time payments from clients.

Palmpay

Palmpay, an MMO licensee, has increased since its inception in 2019, with 30 million smartphone users this year. This milestone triples its user base since announcing 10 million users last year.

PalmPay’s approach relies on its 1.1 million business customers. In Nigeria, over 600,000 retailers use PalmPay’s POS and Pay With Transfer services, while 500,000 devoted agents help PalmPay reach millions more consumers with critical financial services.

PalmPay smartphone apps, agents, and shops serve 40 million Nigerians, or 1 in 5, for money transfers, bill payments, and savings.

Palmpay vs. MoniePoint Personal

PalmPay mobile app and MoniePoint Personal signup is easy. These platforms have made their user experiences accessible to many people. Start-up ease for both apps:

PalmPay: PalmPay signup takes minutes. Register by entering your information and authenticating your account with a code provided to your phone after installing the app from the Google Play or Apple Store.

MoniePoint Personal has a simple signup form. Install the app from the app store, enter your information, and verify your account using a mobile code.

PalmPay expands fintech services in Africa, hits 25 million users

Features to Compare

PalmPay and MoniePoint share similar traits but also show their differences. Look at these parts:

Palmpay has over 10 million downloads and 4.6/5 reviews on Google Play. It is the most popular online payment app in the country due to its numerous valuable features. It introduced a 20% annual interest savings scheme to assist consumers save more.

The site offers many prizes. Check-in awards, Lucky Money, Cash Spree, Palm Force, Refer to Earn, and Naira offers. The bonuses are connected to paying water and power bills, cable TV, airtime, data, school and travel costs, and more.

However, Moniepoint has over 500,000 users and a 4.2/5 Google Play Store rating. This is impressive for a platform released a month ago.

MoniePoint Personal gives users points for every purchase and charges N10 for transfers. Users cannot yet pay their power bills or deposit money into their betting accounts. Palmpay offers cash and referral bonuses that the Personal doesn’t.

However, Moniepoint aims to incorporate a pay advance function to expand its offerings. Customers received points for playing digital games on the site. Players utilized these points to play games for large rewards in the recently ended large Brother Naija All-Stars.

Verdict

PalmPay or MoniePoint depends on personal preferences. Your business goals and preferred features should guide your platform choice. PalmPay and MoniePoint are revolutionizing Nigerian financial services with savings plans and transaction-based rewards.

Entering the market, Moniepoint may challenge personal banking. This helps Palmpay. With its rewards system and zero transaction cost, Nigerians trust the digital platform for personal banking. Nigerians will remember how it revolutionized online commerce when other digital platforms failed during the 2023 Naira crisis.

Moniepoint’s payment gateway and other business services attract some business owners.